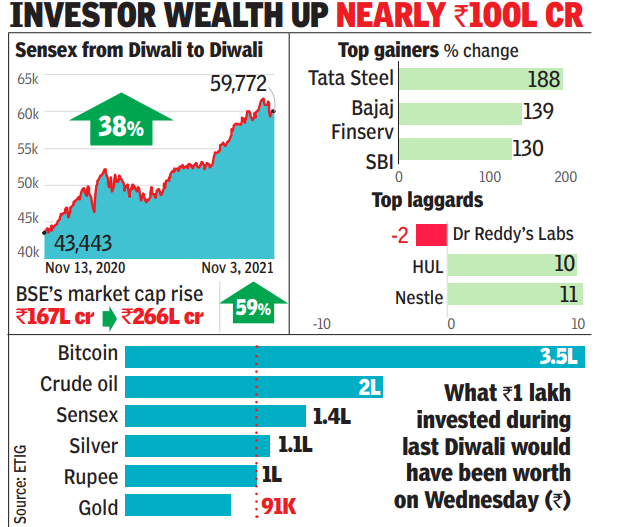

The year ended with BSE’s market capitalization of Rs 266 lakh crore (3.6 tonnes), pushing India to the sixth largest market place in the world in terms of market value. Samvat 2077—a calendar primarily followed by the trading community on Dalal Street—will go down as one of the best years in terms of returns and regularity, with major indices hitting new all-time highs, even as the economy Struggled due to the ongoing Covid-induced pandemic, said market players.

Metals, banking and financial services and software exporters led the rally, while pharma and FMCG stocks saw marginal gains in prices. The gains came on the back of net purchases of shares by foreign institutional investors of around Rs 1.25 lakh crore, while domestic institutions, including mutual funds, insurance companies, banks and other financial companies, were net sellers of around Rs 34,700 crore. Data for CDSL and BSE are shown.

The year will also mark the year when new-age consumer-facing tech-enabled companies, which for years had been privately held by some private equity-venture funds, began listing. The trend, often referred to as privately public by merchant bankers and analysts, was led by a food delivery company. zomato And soon followed by CarTrade. Many companies, including FSN e-commerce (hero), PB Fintech (PolicyBazaar) and One97 Communications (Paytm), are now in various stages of going public during Samvat 2078.

According to Yash Shah, Head of Equity Research, Samco SecuritiesSamvat 2077 can be called the year of unicorns and technology companies. Technology adoption, which was earlier limited to a few sectors, has now become mainstream, Shah Written in a note to customers.

“With the advent of e-commerce, the move to (the) online has driven major changes in sectors such as travel, hotels, restaurants, entertainment and education. With increased internet penetration, smartphone penetration and 5G modernization in India, the user base of Indian tech-driven fintech, edtech, healthtech and e-commerce start-ups is growing rapidly. This trend is supported by India’s growing list of unicorns, resulting in the country having the third largest start-up ecosystem in the world. As a result, it was not unexpected that 2021 provided an apt opportunity for many such start-ups to debut in the public market,” Shah wrote.

The rally of the year on D Street has propelled some Indians into the club of the richest people in the world and Asia. list includes Mukesh Ambani of Reliance Industries, Gautam Adani of Adani Group and Radhakishan Damani of D-Mart.

.