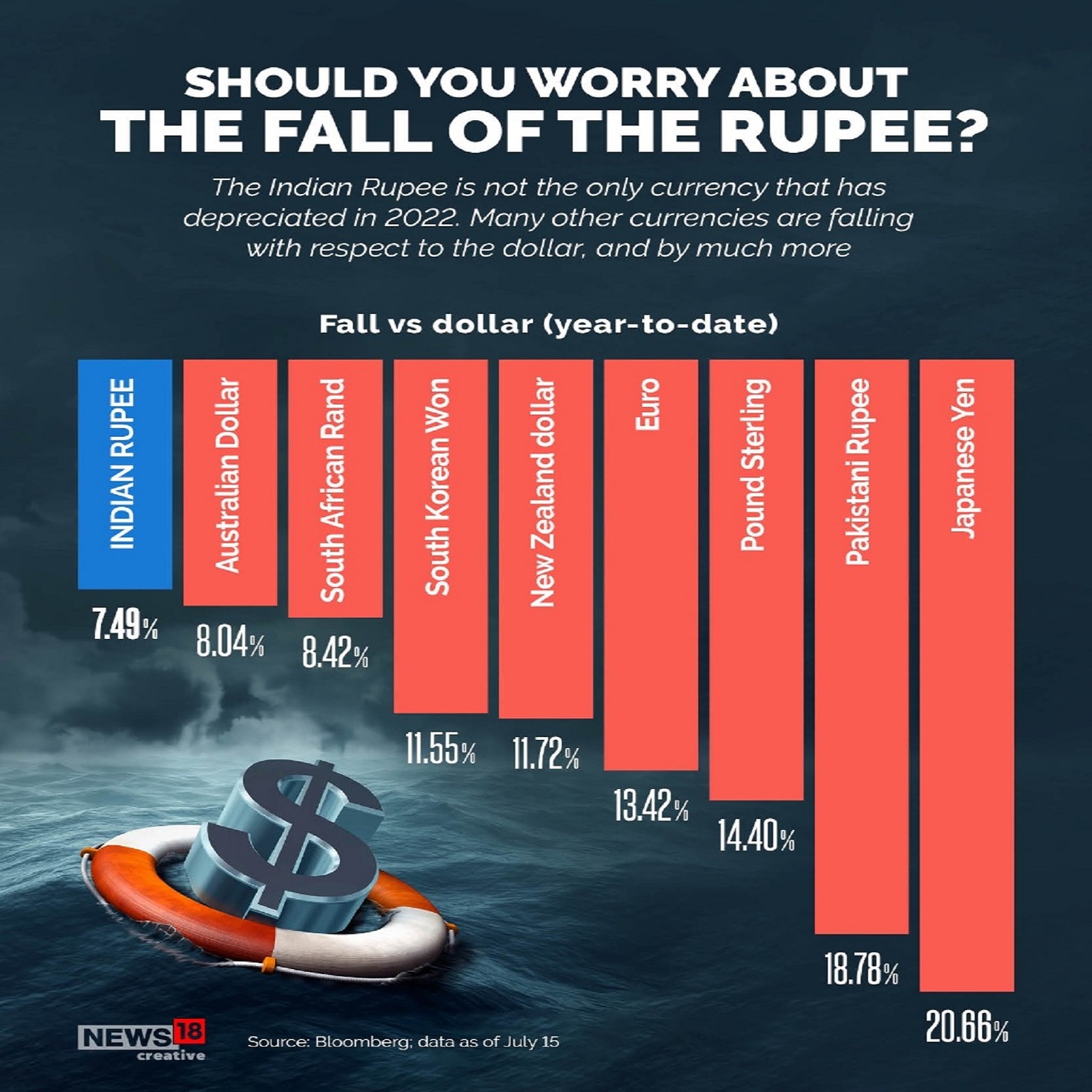

In form of Indian Rupee Due to outflow of foreign capital which has been weakening over the past few months, it is affecting the people by making imports costlier and increasing inflation in the country, which is also reducing the net return on investment. However, experts say that for those planning to go abroad for studies or tours, it is unlikely to be affected significantly as other currencies across the world are also falling against the US dollar.

The rupee has depreciated by about 7.5 per cent against the US dollar since January 2022 due to foreign investment outflows, tighter monetary policy by the US Federal Reserve, rise in crude oil prices and general dollar strengthening. This is further exacerbated by global uncertainties arising from the geopolitical crisis caused by the Russo-Ukraine War.

The domestic currency stood at $73.77 per dollar on January 12, 2022. It is now at 79.90 against the dollar. It hit a record low against the US dollar for the fifth consecutive session on Friday and opened 5 paise lower at 79.92 against the US dollar. The rupee had closed at 79.99 against the dollar on Thursday, according to Interbank Exchange data.

However, recently, euro It also broke parity with the dollar and fell to $0.9998 against the greenback, which broke below the $1 level for the first time since December 2002 and bounced back to $1.0024.

How is weakening of currencies affecting foreign travel planners?

Those going abroad are required to convert the domestic currency to the currency of the destination country. A weaker rupee means that more money will be needed to exchange the same currency than before. However, if the currency of your destination country is also falling, it is unlikely to affect you. For example, the euro, which was Rs 83 against the rupee some time ago, is now below Rs 80.

Sudarshan Motwani, Founder and CEO, BookMyForex.com says News18.com“A weaker euro would make travel to European countries, including Greece, Paris and Italy cheaper, because the cost of amenities such as accommodation, ground transport, fees at attractions, guide fees and meals are included in the euro component, which works around the cost. 50-60 per cent.”

However, he also said that travelers going to the US or other countries whose currencies are pegged to the dollar will have to spend more money for their international travel as the rupee depreciates. “Indian visitors will now need to spend more rupees to buy the dollar equivalent amount, which will substantially increase the total cost of their trip.”

Anindya Banerjee, Vice President (Currency Derivatives and Interest Rate Derivatives) Kotak Securities has said that as long as the depreciation in the rupee remains slow, there should not be a significant impact on Indian students going abroad for studies.

Here’s what people should do: Forex markets have become very volatile and therefore, it is strongly advised to hedge currency risk by purchasing foreign currency (forex) cards at fixed rates. “Furthermore, travelers should keep an eye on foreign exchange rates if their travel plan is in place and freeze their travel money rates as soon as the rates seem desirable,” Motwani said.

How is a weak rupee affecting inflation and thus investment?

As most crude oil, edible oil, auto parts and pharmaceutical material India are imported, the weakening of the rupee increases the prices of these commodities, leading to inflation in the country.

The high rate of inflation affects the overall annual return for investors. For example, if a portfolio has given a 10 percent return to an investor and inflation is 4 percent, the actual rate of return is 6 percent. But, since higher inflation lowers the profitability of companies due to higher cost of inputs, returns on stocks also decline. Suppose, now, a portfolio gives an investor now 7 per cent lower returns and the rate of inflation is also 7 per cent. In this case, the real rate of return is zero. Therefore, inflation affects both a company’s profitability and its actual return to investors.

VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services, has said that rupee depreciation augurs well for export sectors, especially IT (Information Technology) companies. Exporters of specialty chemicals and textiles will also benefit.

Export-oriented stocks like specialty chemicals, IT and textiles could be seen amid the fall in the rupee as they could gain on higher overseas demand; While sectors such as metals, banking and fast-growing consumer goods are on the receiving end.

read all breaking news, today’s fresh newswatch top videos And live TV Here.