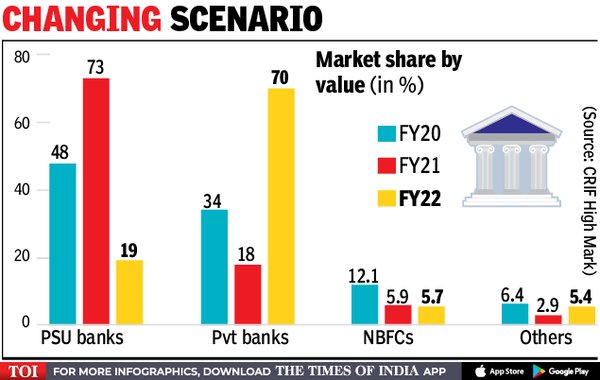

Public sector banks, which accounted for 48% of all credit restrictions to MSMEs in FY10, increased the share to 73% in FY2011 following the pandemic, with most of it going towards Mudra loan,

However, in FY22 when competition for credit intensified, the share of PSU banks in lending to small sectors declined to 19.1%.

Before the pandemic, many private sector banks had become cautious in lending to small businesses and as the pandemic spread, they began to hedge their exposure. With government guarantees coming in and tensions lower than expected, they rapidly increased their market share in FY22.

a report from a credit information company CRIF High Mark has said that the outstanding portfolio for the MSME industry stood at Rs 22.7 lakh crore as of March this year – an increase of 18% over March 2021 and 36% from March 2020. The value of the total sanctioned amount of the loan at the end of FY 22. 37.3 lakh crore – a growth of 5% in FY2011 and a growth of 182% in FY2010. The average ticket size of MSME loans has increased from Rs 37.7 lakh in FY20 to Rs 72.4 lakh in FY22.

Loans to small businesses during the pandemic were extended by the government by providing guarantees for new exposure Emergency Credit Line Guarantee Scheme ,ECLGSFurthermore, in the post-pandemic period large corporates, which have historically been major consumers of bank credit, defaulted on loan repayments and moratoriums on borrowing. The MSME segment is expected to remain in focus as the Reserve Bank of India has decided to keep FY23 as the year of MSMEs. The government is also looking for small businesses for employment generation.

As per the CRIF High Mark Report, in terms of the number of borrowers, the total active lending to the MSME industry stood at 137.4 lakh accounts as of March 2022 – a 7% increase in March last year and a 43% increase in March 2020. The top five districts of Mumbai, Mumbai Suburban, Chennai, Kolkata and Bengaluru constituted 56% of the total origination value in FY 2012.