A Rs 2 horlicks The sachet gives a cup to the consumer, while Clinique Plus Shampoo for Re 1 offers a woman a complete hair wash. As inflation continues to rise, it is becoming a challenge for FMCG manufacturers to maintain these price points by reducing the quantity per pack – called gramage. “You can’t go below a point. If the amount of a Rs. Clinique Plus shampoo falls below a certain limit, it will not allow a complete hair wash. There are certain limits that we operate within, And we can’t drop the quantity beyond that,” said Hindustan Unilever CFO Ritesh Tiwari.

Inflation is hurting unit economics, a measure of the profitability of FMCG companies selling one unit of the product. Low unit price points (LUPs) are sacrosanct, but due to lack of grammar, these massive packs are said to be close to the threshold below which they will fail to give consumers value for money.

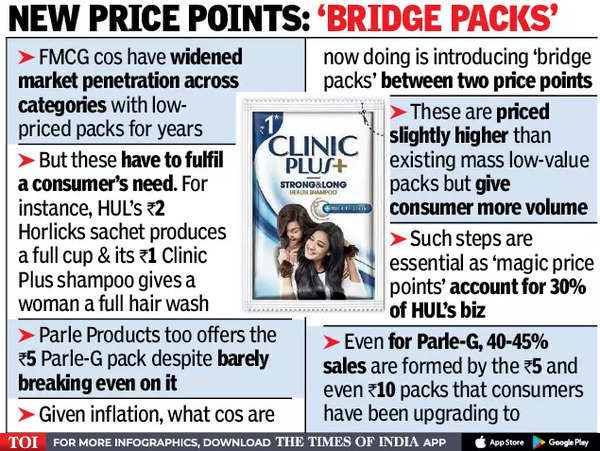

“LUPs such as Rs 1, Rs 2 or Rs 5 in different categories serve a major purpose. Each of these price points is established over a period of time to drive penetration. When inflation picks up and the cost of the product in the price point becomes challenging, there are certain limits within which you can title these volumes,” Tiwari said.

parle Mayank Shah, Head of Product Senior Category, said since one cannot change the price point on a smaller pack, the only option to manage the cost in this high inflationary period is to reduce the grammar. “What used to be 100 grams at one time is available today for almost half the volume for the price of Rs 5. But the quantity available after the reduction in grams is not enough to satisfy one’s hunger,” said Shah, adding that Parle Products is determined to continue with its Rs 5 pack of Parle-G biscuits, even if it doesn’t cost them Gives less margin.

Shah said the company will never close the price point due to its stated objective that it does not want to make money on a stock keeping unit (SKU) of Rs 5 so that it is affordable to the masses. “We barely break even on Parle-G’s Rs 5 SKU, with margins in the low single digits. But we will continue to ensure that it remains in the market as biscuits are the lowest cost food for consumers and thus affordability is important,” Shah said.

Shah of Parle Products said in biscuits that consumers are likely to go for Rs 10 pack to get better volume. “We are witnessing consumer trend towards Rs.5 to Rs.10 packs in Tier-1/Tier-2 cities,” he said. The Rs 5 and Rs 10 packs together contribute 40-45% to the sales of Parle-G.

As per the data compiled by Bijom over the past one year, Rs 10 is fast emerging as the price-point for biscuits. Bizom, a platform that automates retail execution at 7.5 million kirana stores, is seeing a 2.4% revenue share decline at the Rs 5 price point over the last year, while increasing revenue share at the Rs 10 price point have increased. 5 as well as up by 3.8% due to shift from higher prices to Rs 10.

Akshay D’Souza, Head of Development and Insights, Bizom, said, “Low Grammarly at lower price points driven by high food inflation is driving consumers to look for packs that deliver value (i.e. more gram biscuits per rupee) and so on. 10, which is fast emerging as a good price point, may also indicate that more consumers are upgrading from earlier single-use packs to multi-use packs. which they were buying to manage their expenditure proportionately.”

HUL, on the other hand, is creating bridge packs (between two price points) to provide the right value-price equation to its consumers, ensuring that the products remain affordable and accessible. The company plans to introduce more Bridge packs across all categories. In the next few quarters, it will start activating these. Tiwari said the move would also help in the development of the market for these categories.

When unit economics become strained due to inflation, Tewari said, consumers can usually move to the bridge pack by paying more at a new price point than the price they would buy. their Introduced Lifebuoy Pack at Rs 16, which is a bridge pack between Rs 10 and Rs 36 price point pack. “When consumers find value in these price points, we get good unit economics. That is the sweet spot we are trying to work on now,” Tiwari said.

When asked whether HUL has reached or is close to reaching that limit – say, on a Re 1 shampoo pouch – Tewari said, it is probably the right time to plan long term on where commodity inflation and volatility are. there’s no time. 1 bucks pouch, either way. “One should wait for a quarter or two to see where commodity inflation is right now. As things stand, we see that there is sequentially higher inflation in the June and September quarters. We expect this inflation to peak in the next one or two quarters. As people are seeing the impact on their wallets, they are reducing consumption, which ultimately has an impact on volumes. In times of high inflation like this, our priority is to provide value to consumers, invest in our brands and protect our financial business model. Our first port of call is always to make savings hard. We then take calibrated pricing action while protecting and growing our consumer franchise,” Tiwari said.

For HUL, around 30% of its business comes from packs that operate at these ‘magic price points’. In addition, about 30% of its portfolio is value-off.