Experts told TOI that increased container demand and high traffic are the major factors contributing to the shooting of $2,489 (per unit price for 20 feet dry container, or DC) in average container price in Mundra in May. Dry storage containers (20 or 40 feet long) are the most common containers used in shipping dry goods, which do not contain items such as food or chemicals that require refrigeration.

Experts said that given the change in maritime dynamics, India has an opportunity to divert some sustainable shipping towards its shores and move up the global value chain. “Due to the Colombo crisis, more and more transshipment containers are directed to east coast ports in India,” said Christian Roloff, founder and CEO of Container Exchange, a logistics tech company that provides a container trading and leasing platform . He said ports in South India have gradually started expanding their capacity to handle the increased cargo traffic due to the ongoing crisis in Sri Lanka.

Another important sign is an increase in container availability index (CAx) values in Nhava Sheva from 0.76 at Week 22 to 0.73 at Week 21 (last week of May). In the coming weeks, CAx is expected to drift between these two numbers. CAX values of more than 0.5 mean that more shipping containers are entering Indian ports, and there is less demand for export boxes.

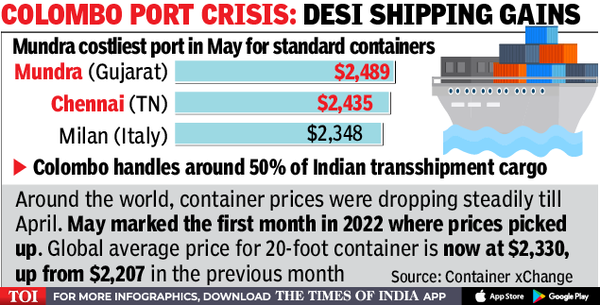

May marked a peak in global container prices for the first time around the world this year, reaching $2,330 (up from 2,207) for 20DC and $4,410 ($3,800) for 40HC (high cube) containers. Last year, trade – both exports and imports – was severely affected, with sea freight costs rising by 200% from China and a severe shortage of containers. Amid tensions in Sri Lanka, the Indian subcontinent’s reliance on the port Colombo is also being highlighted. About 3 million TEU (twenty foot equivalent units) of export-import (EXIM) cargo is shipped from India through Colombo port every year. Thus, it handles about 50% of Indian transshipment cargo.

CareAge Rating associate Director Arunav Paul “Preliminary estimates suggest that 50,000-70,000 TEU of EXIM cargo is expected to be transported to Indian ports during the April-June quarter of 2022. However, this is marginal and accounts for only 2% of the total transshipment cargo shipped from India. Intermittent operational disruptions in Colombo port have extended the turnaround time for ships. However, ships that cannot wait are only being diverted to Indian ports. The total volume diverted is not very meaningful as compared to the total transshipment cargo volume. The overall volumes at Colombo Port have not been affected much. But if the disruption continues for a longer period of time, it may also benefit the southern ports and Mundra port, which has deeper draft and mechanized cargo handling for faster turnaround of ships.

In the long run, there is an opportunity to develop a transshipment port to partially replicate Colombo. The deep draft to handle large vessels, geographical location and competitive pricing are the main advantages of Colombo port over its Indian counterparts. Paul said the international port and container transshipment terminal at Vizhinjam (Kerala) could provide the best option once developed.