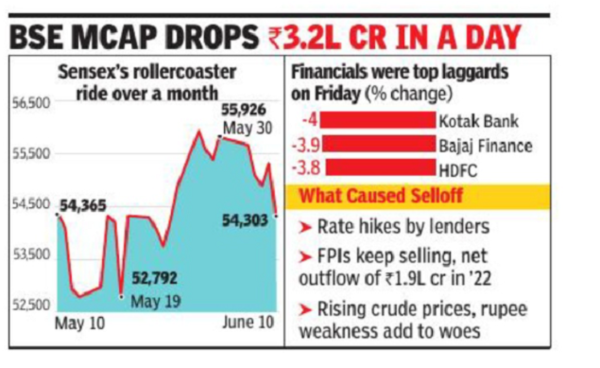

The index lost steam during the session and closed down 1,017 points, or 1.8%, at 54,303, after opening nearly 600 points after a late night sell-off in the US market. on NSE, nifty It closed at 16,202, down 276 points, down 1.8%. Like in the past several weeks, the day’s sell-off was led by foreign funds.

BSE The data showed that the net exit from the stock market on Friday was around Rs 4,000 crore. On the other hand, the net purchase of domestic funds stood at Rs 2,831 crore. Reliance IndustriesAlong with banks and IT stocks, led the Sensex’s fall. Out of 30 Sensex stocks, only eight closed with gains. Official data shows that selling off the session along with the market capitalization of BSE reduced investors by Rs 3.2 lakh crore. 2 lakh crore rupees.

According to MK Wealth Management Head (Research) Joseph ThomasShanghai being once again closed soon after reopening, low global economic growth prospects, and pessimistic projections of expected key data such as US and India CPI (consumer price index) inflation are factors that have fueled panic among investors. Has caused some disappointment. , “The US Fed Next week’s meeting, the results of which will be known by the evening of June 14, is also a major event the markets have been waiting for, and most analysts expect an increase of 50 basis points (100bps = 1 percentage point) by the Fed . ,

Looking ahead, the rapidly rising number of COVID-positive cases in India may weigh on investor sentiment. Thomas wrote in a note that continued sales of foreign funds are also being impacted. according to data compiled from CDSL And BSE, in 2022, so far, foreign funds have net unsold stocks of around Rs 1.85 lakh crore, while across all asset classes – including stocks, debt and hybrid instruments – net outflows are a little over Rs 1.9 lakh crore . ,