Nifty 50 at 17,500 level! What will happen next?

Major benchmark Indian stock market index, Nifty 50 is swinging at an unprecedented 17,500 levels (approximately) and the free-float market-weighted stock market index, Sensex, breached the elusive 55,000 mark recently. Indian stock markets witnessed a bull run and a massive rally for the first time, and it could set new levels every day. With all this in mind, it becomes extremely important for an investor to examine whether all these phenomenal runs are being backed by fundamental data or not, and how strong are these levels?

Ravi Singhal, Vice Chairman, GCL Securities Pvt Ltd suggests that there is no need to worry about the high levels of these stock market indices as the price of any stock or index is always a reflection of its earnings base.

“We are all well aware of the fact that the pandemic has hit the earnings of businesses very badly. Therefore, now that businesses are back in financial action, almost every company’s earnings should improve in their quarterly results. has been,” he said. .

If we look at the consolidated earnings of Nifty 50 companies, it was at an average of around Rs 358 per share in August 2020 and has been improving since then. The same figure averaged Rs 446 in April 2021 and Rs 607 in August 2021.

“So if we look at this year’s PE data, it is showing a steady decline even though the major indices are touching new levels,” he said.

Nifty 50 at 17,500 level! What will happen next?

Considering the above data, now a big question arises here – is it worth buying in Nifty 50 at 26.25 P/E? To answer this, we have to look at some key facts here:-

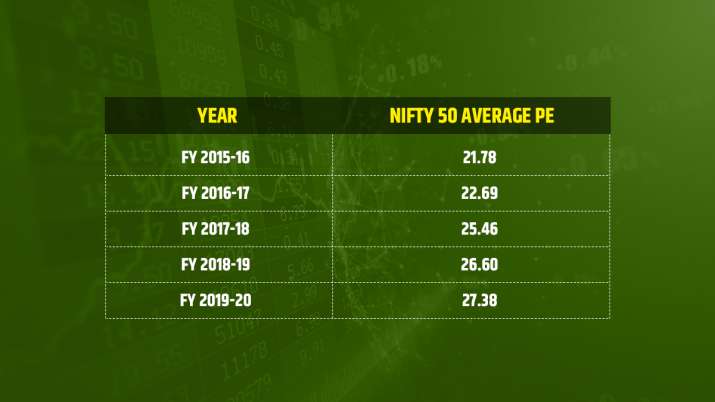

1. Historical P/E: FY 2020-21 was the exception, so we cannot take this year’s figures into account while calculating the average. However, taking a look at the historical data for the 5 years prior to FY2011, the Nifty 50 P/E average was 24.78 from the beginning of FY 2015-16 to the end of FY 2019-20.

Nifty 50 at 17,500 level! What will happen next?

Therefore, at the level of 26.25 it is about 6% higher than the average of the last 5 years.

2. Nifty 50 P/E Calculation: As we know, NSE has changed the calculation method for Nifty 50 P/E. Now it is calculated on the basis of consolidated earnings of all companies instead of standalone P/E. This calculation has changed the P/E data significantly. It is important to note here that after this calculation change came into effect, the Nifty 50 P/E immediately dropped from 40.43 to 33.2 on 31 March 2021.

3. Future Growth: If we evaluate the P/E of a company or an index, we should also look at future earnings expectations. The current high P/E may be the result of market expectations of higher earnings in the future.

Conclusion: The P/E is the most important factor for analyzing the strength of the market and is moving above its 5-year average. This could be a result of the market expectation of higher earnings growth of Nifty 50 companies, but at the same time, we also expect further improvement in earnings as the festive season performs well and monsoon is going well across India. Lastly, long term investors who have an investment horizon of 3-5 years should not be at all afraid of Nifty 50 and Sensex’s levels of 16,500 and 55,000 respectively.

.