edited by: Namit Singh Sengar

Last Update: February 09, 2023, 17:08 IST

The report said that Indian mutual funds counter-balanced FIIs. (Representational Image)

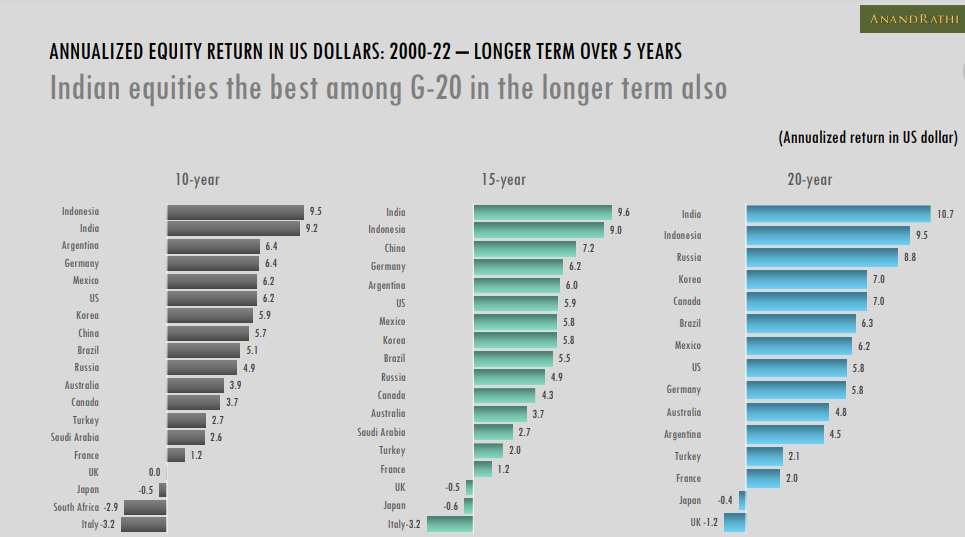

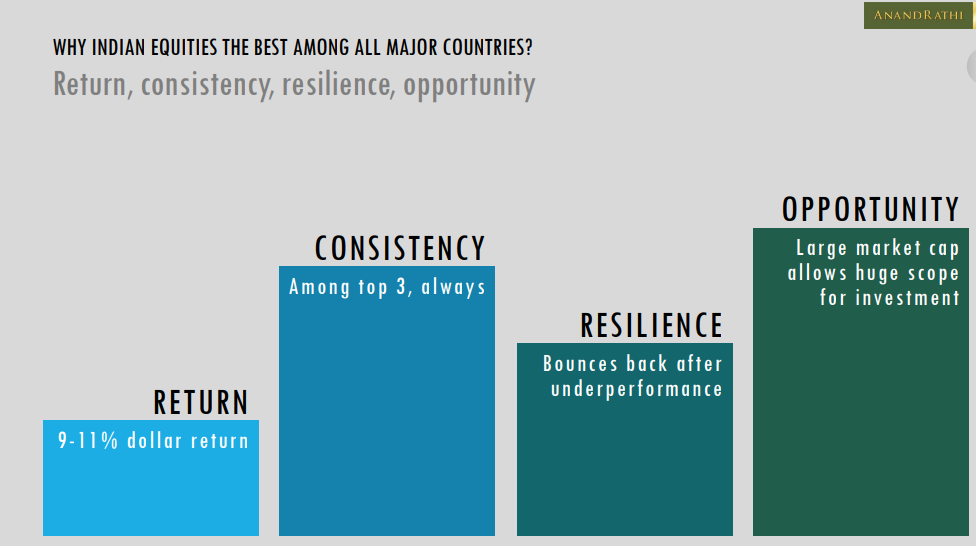

The report states that Indian equities are among the best in the G20 in terms of returns and consistency.

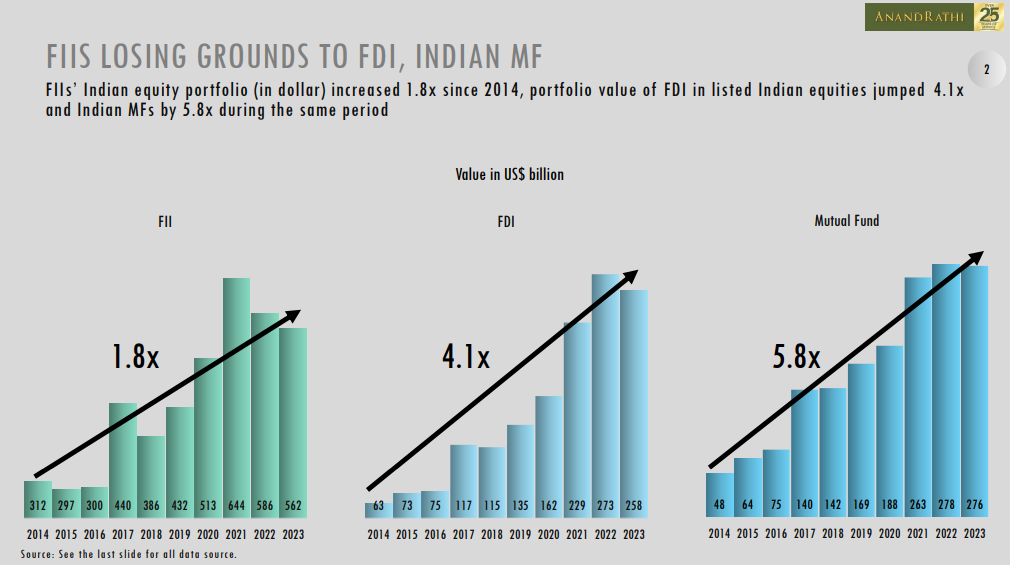

Foreign Institutional Investors (FIIs) seem to be losing ground to Foreign Direct Investment (FDI), Indian Mutual Funds.

According to a report by Anand Rathi Shares and Stock Brokers, the Indian equity portfolio of FIIs (in dollars) has grown by 1.8 times since 2014 and the portfolio value of FDI in listed Indian equities by 4.1 times and Indian MFs by 5.8 times during the same period gone up.

It added that Indian equities are among the best in the G-20 in terms of returns and consistency.

The report said that Indian mutual funds counter-balanced FIIs.

Indian mutual funds neutralized the effect of FII selling in 2022. It was noted that money for MFs is coming mainly through SIP.

Notably, investors are betting big on SIPs to generate long-term wealth, with monthly inflows rising to an all-time high of Rs 13,040 crore in the mutual fund industry in October, 2022.

Annual Equity Returns in US Dollars: 2000-22 – Long term over 5 years;

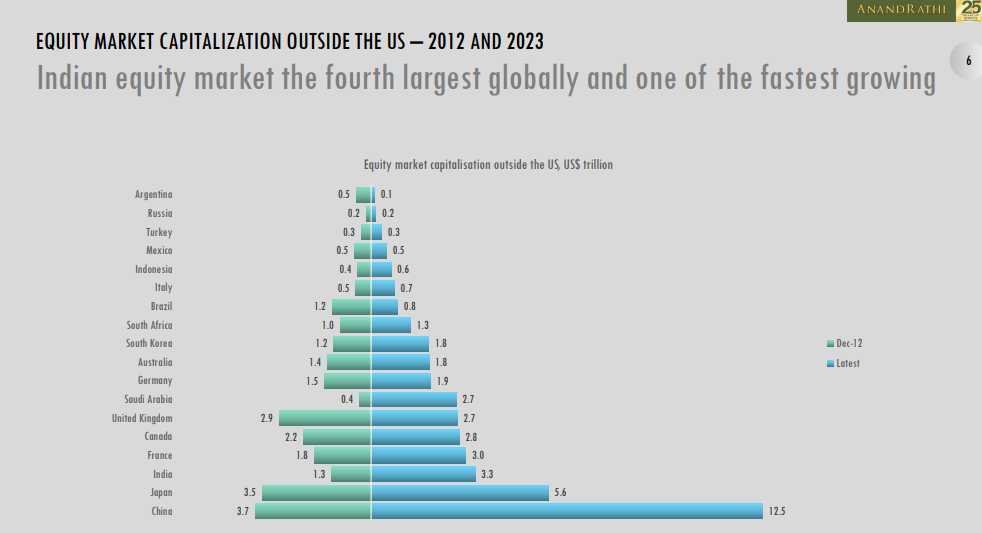

Indian equity market is the fourth largest and fastest growing market globally.

Why Indian equity is the best among all major countries?

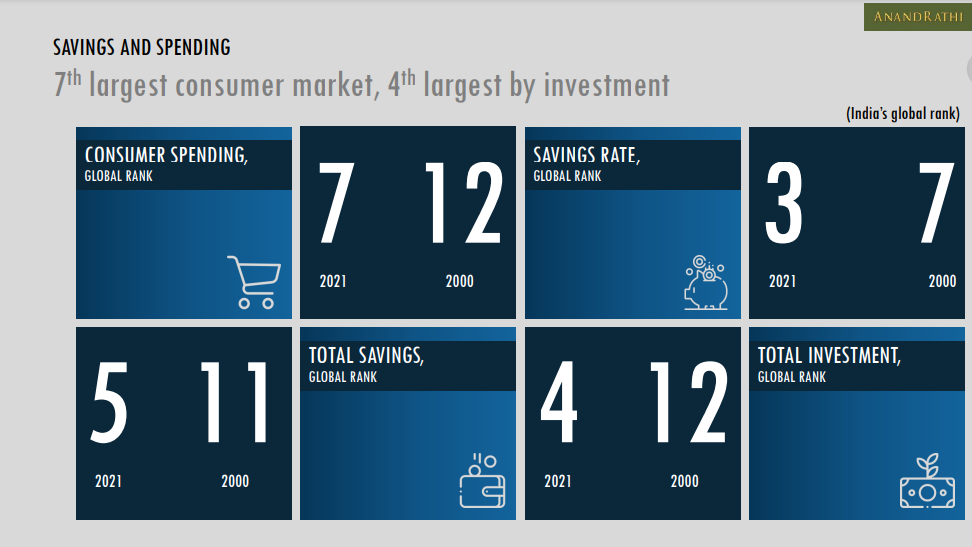

savings and spending

read all latest business news Here