The UK government said in a statement, “Based on London’s central role in the gold trade, “the measure will have a global reach, weaning off the commodity from formal international markets” and on President Vladimir Putin’s ability to raise funds “heavy”. effect”.

Shipments between Russia and London have dropped to almost zero since Western countries imposed sanctions on Russia for its invasion of Ukraine. The London Bullion Market Association, which sets standards for that market, removed the Russian gold refiner from its accredited list in March.

“What it does is formally what the gold industry has already done,” said Adrian Ashe, head of research at brokerage BullionVault.

The measure will apply to gold leaving Russia for the first time and the Treasury Department will issue US sanctions on Tuesday, according to a person familiar with the plan. An executive order signed by President Joe Biden on April 15 banned American individuals from engaging in gold-related transactions with Russia’s central bank, the country’s National Wealth Fund and its finance ministry.

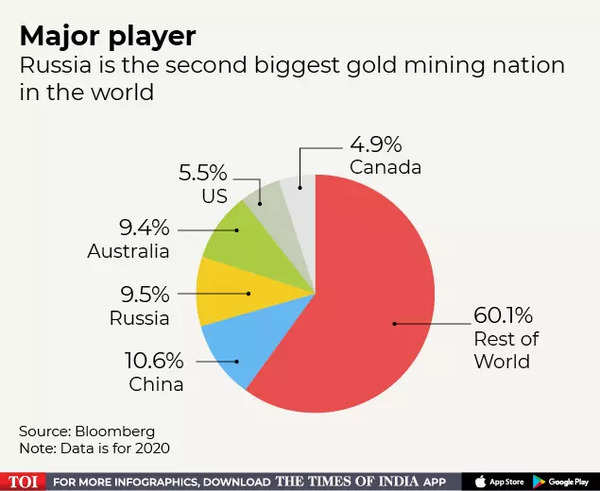

While Western sanctions to punish Russia have shut down European and US markets for gold from the world’s second-largest bullion miner, the G-7 pledges total distance between Russia and the world’s top two trading centers, London and New York. will mark the break. The other G-7 countries are Germany, France and Italy.

London has been one of the most important destinations for Russian precious metals: the $15 billion in Russian gold that arrived there last year accounted for 28% of UK gold imports, according to UN Comtrade data.

While refineries could in theory still import Russian gold directly, most have vowed to do so. The Swiss Refiners Association, which dominates the industry, denied that its members had bought gold from Russia, as trade data indicated the country’s bullion had entered the country.

Britain’s Prime Minister Boris Johnson said in the statement that the sanctions would “directly affect the Russian oligarchs” to buy gold from Russia’s elite in an effort to avoid the financial impact of the sanctions. According to the statement, the import ban, which will come into effect soon, will be applicable to newly mined or refined gold.

Other metals such as copper, nickel and palladium continue to flow from Russia as the commodities industry grapples with managing a longstanding relationship with a major supplier of the world’s raw materials.

Meanwhile, Russia’s gold industry is exploring new sales options, such as exporting more to China and the Middle East, which are not part of the G-7.

Spot gold rose 0.4% to $1,833.86 an ounce as of 6:32 am on Monday in Singapore. After hitting nearly record highs in March, prices have changed little this year as the war in Europe boosts demand for the haven property.