India has established itself as one of the leading markets for electric vehicles (EVs) across the globe, with several local players now coming up with their own electric vehicle offerings. EV adoption can be seen across various vehicle segments as well as various business segments. To drive India’s transition towards EV ambitions, favorable plans and policies have been developed by the government such as the National Electric Mobility Mission Plan (NEMMP), Faster Adoption and Manufacturing of (Hybrid) and Electric Vehicles (FAME) scheme.

Adding to these, many state governments have announced their EV policies with different focus which will increase the demand for EVs in their respective states. The policies of some states like Maharashtra and Delhi are aimed at boosting demand, while other states like Uttar Pradesh and Tamil Nadu intend to strengthen the supply side for EVs by encouraging local manufacturing of EVs.

India has also committed to net zero emissions by 2070 at the Conference of the Parties (COP 26) and the country has taken several clean mobility initiatives to promote EV adoption. Thus, electric mobility has become the preferred choice in India due to international commitments, incentives for EV procurement and efforts and initiatives taken for sensitization of the masses.

Gaps in the EV Industry That Can Be Considered as Emerging Opportunities

While the government has brought in significant policy changes, original equipment manufacturers (OEMs) have made efforts to remove barriers through innovation, and consumers have demonstrated readiness and willingness to accept this change, the country is yet to There is also a need to take more initiatives to promote the supply side. , including local manufacturing of electric vehicles and components. In terms of value, an EV consists of 35% battery, 25% drivetrain, 20% chassis and 20% systems and other equipment.

At present, India imports most of these components as the country has limited manufacturing facilities. India has matured into the traditional drivetrain and chassis manufacturing segment, however there is ample scope for improvement by manufacturing these for EV specific applications which include lightweight chassis, electric drivetrains etc.

In addition, EVs are technologically advanced and require semiconductor chips to ensure the operation of their electronic components such as wireless communications, autonomous vehicle systems, firmware, mobile applications, connected vehicle services and security. Thus, EV manufacturers are facing immense pressure due to component shortage. Thus, it is imperative for the government to support the industry in formulating innovative strategies to enhance domestic manufacturing as per the ‘Make in India’ philosophy.

Along with the EV components, there is also a need to augment the EV charging infrastructure to meet the growing EV demand. This infrastructure for EV charging includes the EVSE (Electric Vehicle Supply Equipment), battery storage system and other related components. These components are assembled to manufacture the final product in India but are still largely dependent on imports.

Many startups and EVSE SMEs (Small and Medium Scale Enterprises) are now focusing on indigenization of these components. This indigenization can be further enhanced with government incentives/exemptions and creation of conducive ecosystem for companies to set up manufacturing facilities.

The future of the Indian EV ecosystem should be encouraging domestic manufacturing

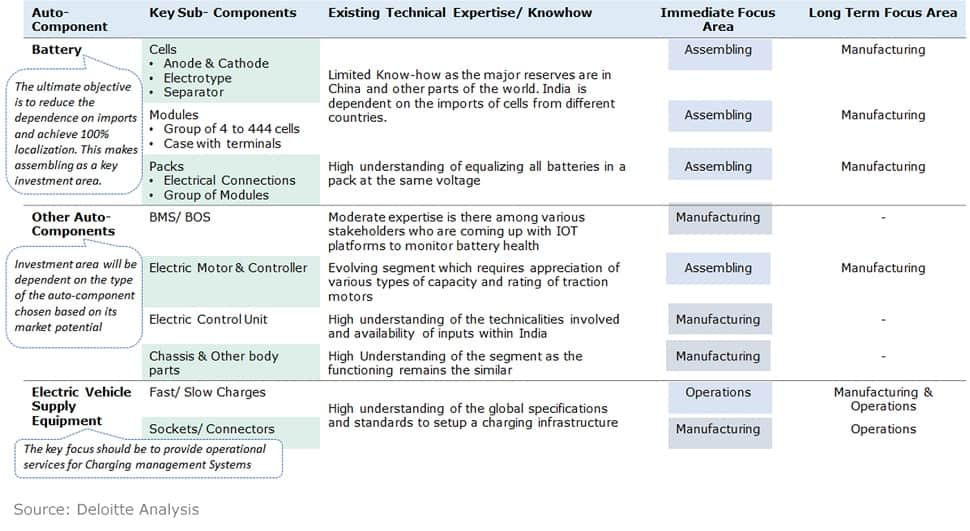

Batteries are the biggest contributor to EV cost which is around 35%. In addition, the chassis, body and BMS (Battery Management System) are more likely to be localized, while the localization of particular components such as the battery and motor may be limited. Further, to facilitate localization in India, a phased mobilization of investments may start from assembling and then gradually move on to manufacturing.

This phased transition will help in import substitution of key auto components and improve its export share, make a shift towards electric mobility by meeting global demand and make India ‘self-reliant’. An indicative phasing strategy for the key components is presented below:

Thus the current budget needs to focus on ensuring a strong supply of products and services in the EV automotive domain. This should factor into the taxation as well as incentive mechanism for EV manufacturing. Various national and state level tax exemptions and incentives available for EV manufacturing can be combined with rigorous implementation plans to promote the supply of components and manufacturing EVs. In addition, the government may create a conducive policy environment to support new technology partnerships and tie-up of international players with Indian players leading to greater localization and expansion of manufacturing of EVs in India.

The supply side can be further enhanced with focused investment in R&D of EVs and EV components to cater to local manufacturing. The upcoming development in the EV automotive industry also requires advanced training and upskilling of the workforce. There is also a need for additional incentives and exemptions for manufacturing of various EV components to ensure less dependence on imports. Import of finished products should be discouraged while encouraging domestic manufacturing.

To facilitate this, the budget may include proposals for specific manufacturing support for the EV industry focused on localized manufacturing of electric vehicles and components as well as implementation support for infrastructure components such as EVSEs, charger components and connectors.

This article is authored by Sumit Mishra, Director, Deloitte India and Sahil Bhandare, Consultant, Deloitte India. All views are personal.

#Mute

,