With a population nearly twice that of the US, the pace of the region’s outbreak has now eclipsed previously hard-hit places such as Latin America and India, with a 41% increase over the past week to half a million, according to Bloomberg. More cases have been reported. analysis of Johns Hopkins University data. Deaths rose by 39% in the seven days from Wednesday, the fastest pace in the world, and could potentially rise further as the death toll usually follows a surge in cases.

growing crisis

Meanwhile, Southeast Asia’s overall vaccination rate lags 9%, with developed regions such as Western Europe and North America – where more than half the population has received the shots – and overtaken only by Africa and Central Asia.

As large parts of the developed world reopen for business, deteriorating conditions in much of Southeast Asia mean they are re-enacting the growth-stagnation movement. Singapore is the exception, where sealed borders and high vaccination rates make the virus the region’s only developed economy to contain.

Equities and currencies across the sector have been sold off in recent weeks, while governments are forced to shore up their fiscal deficits and central banks are short of ammunition. it comes as US Federal Reserve Provides preliminary discussions on how to reduce asset purchases for policymakers in Asia to further ease policy without risking weaker currencies.

leader and backward

Sean Fenner, Singapore-based Senior Asia Economist at Oxford Economics Ltd., said: “Given the slow pace of vaccination, with the exception of Singapore, we expect the recovery to be bumpy, and the risk of increased restrictions in the period ahead. shall remain.” Increasing uncertainty is likely to lead to further economic crisis.

Indonesia, Southeast Asia’s biggest economy, overtook India in new daily cases this week, cementing its position as a new Asian virus epicenter, while many of its neighbors are also seeing record case numbers.

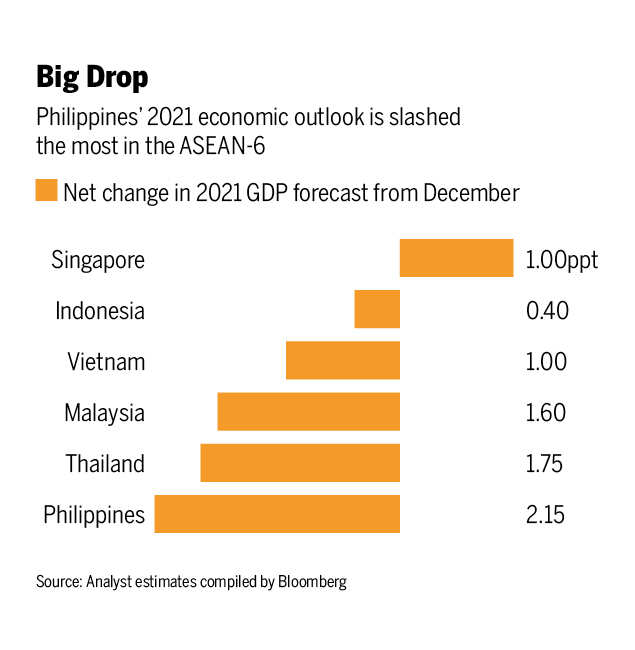

Indonesia, Thailand and the Philippines have already cut their GDP forecasts for this year, and Malaysia says it will soon follow. Vietnam, one of the few economies in the world that continued to grow strongly last year, has lower forecasts for the first half of 2021 and is now battling an outbreak in areas with major industrial parks.

Before the pandemic, the largest economies in Southeast Asia would have been the fifth largest in the world after Germany combined. world Bank data.

Southeast Asia is buoyed by strong global demand for exports, especially electronics, as the pandemic has taken away traditional drivers such as consumption and tourism. However, external demands may change, which can further increase pain for the area.

“Now that advanced economies in the West are reopening, their demand dynamics will shift from goods to services, meaning Asian export growth will moderate in the coming months,” said Singapore-based Asia Head Tully McCulley. ” Pacific Economics scotiabank. “To keep the economic recovery on track, domestic demand will need to be boosted, yet the associated virus situation is making such possibilities less likely.”

Led by shares in Vietnam, the MSCI ASEAN index is down 1.7% this month, extending its 3.4% slide in June. Asia’s worst-performing currency this year, Thailand’s baht, has lost about 5% since mid-June, when the delta version emerged in the country, while the Philippine peso is down 4.2%.

In a note on Thursday, Goldman Sachs Group Inc. Economists said they were lowering their forecast for second-half growth in Southeast Asia at an average of 1.8 percent, with the biggest cuts for Indonesia, the Philippines, Malaysia and Thailand.

Economists said the new outbreak and tighter restrictions “are likely to weigh significantly more on GDP growth in the second half than we previously anticipated.”

big drop

This happens because policy interest rates across the sector are at or near their all-time lows and governments find themselves with limited space to spend more.

Malaysia, which has already passed four stimulus packages this year, says it is looking at raising the debt limit as it is out of fiscal space. Indonesia recently indicated that after raising the statutory limit last year, it would not be able to contain the budget deficit as quickly as planned. The Philippine government, which last week repaid a loan of 540 billion pesos ($10.8 billion) from the central bank, quickly backtracked and made another demand.

Andrew Wood, a Singaporean, said the need to increase stimulus spending, while simultaneously reducing revenues, means “a more difficult start of fiscal consolidation for these governments in 2020 after high shortfalls, and in many cases weaker fiscal performance this year.” ” Analyst based for S&P Global Ratings.

In its recent move to negative the Philippines’ credit rating, Fitch Ratings noted that the pandemic creates a potential “scarring effect” that could stifle medium-term growth. The S&P issued a similar warning to Indonesia on Thursday, saying the Covid-19 surge and extended lockdowns have a material impact on the economy and will clear credit rating buffers.

‘Wrong trade off’

Rob Carnell, head of Asia-Pacific research at ING Groep NV in Singapore, said poorer Southeast Asian countries that tried to limit lockdowns early in the pandemic to minimize the impact on people’s livelihoods paid the price for that option. Mainly because their efforts to test, trace and isolate positive cases were ineffective. As a result, countries such as the Philippines and Indonesia have opted for partial, rolling lockdowns, forcing them to continue in some form or the other.

“It was easier for rich countries to lock down and pay people to stay at home or work their way up while they were, and poorer people tended to trade restrictions with openness to limit the hit to GDP. Tried it,” he said. .

“Of course, this was a false trade-off – only a short-term trade-off at best,” he said. “We are probably starting to see the impact of such policies now.”

.