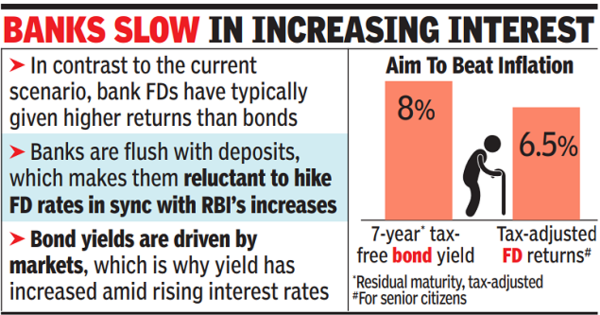

According to financial advisors, banks, along with funds, are reluctant to hike FD rates, while market-driven bond yields are offering very high returns in the rising interest rate scenario. For example, bond market players reported that tax-free bonds with a residual maturity of around seven years are offering a tax-adjusted yield of around 8%, compared to about 6.5% for senior citizens from FDs in large banks. Can get it. This is a very different scenario as compared to earlier when banks used to give higher returns than FD bonds.

at a time when inflation Harming people at every level, slightly higher returns on fixed income Property Financial advisors said higher expenses due to rising inflation may provide relief to people dependent on such income.

“To deal with rising inflation, reserve Bank of India Interest rates have been hiked in the current cycle. As a result, banks have increased their lending rates. However, the increase in FD rates has not happened in the same proportion.” Dilip Kumar Dey, Founder, Lakshmi Finance Traders, a Kolkata based investment advisory outlet. “Given how the situation has unfolded, corporate bonds and government securities appear to be a better and safer option than FDs for individual investors.”

Even government securities (G-Secs), which offer complete protection, are giving good returns.

In a market where inflation is at a six-month average of around 6.6% and benchmark 10-year government securities have recently hit a high of 7.62%, the market favors investors looking for higher returns with higher security. , said Ankit Gupta, Founder, Bondsindia.com, a technology-driven platform that deals in most fixed income securities. “Retired citizens need the highest level of protection with good returns that is offered by government securities with a sovereign rating and inflation rate exceeding that.”

Gupta feels that “retired citizens can take advantage of the high-inflation-high-return dynamic, where they can earn not only higher returns, but also the way the RBI tries to control inflation with its macroeconomic policies.” By trying, investors will be able to earn good returns depending on the market (increased in price) as well as in few years of investment.

Since bond yields and prices have an inverse relationship, once bond prices rise, yields will fall and bond investors may have a higher value of their bond holdings.

G-Sec also provides high liquidity and RBI, through its Retail Direct platform, is trying to bring more retail investors into the G-Sec market. Also, in case of any exigencies for cash, “G-Secs have wide acceptance as collateral,” for loans, Gupta said. According to Day, government bonds being a risk-free investment, ensure proper portfolio diversification benefits in the long run and are also available for longer durations.

For example, government securities maturing in 2051 and 2061 are available at a yield of around 7.55%. This means that investors investing in these bonds will get an interest rate of 7.55% for 29 years and 39 years respectively. No bank will offer such a long tenure FD. Some highly rated corporate bonds are also offering yields of around 9.5%, but for much shorter durations, market data showed.