according to a report of CareAgeBad loans will continue to decline during the current financial year on account of higher credit growth and transfer of heritage assets to National Asset Reconstruction Company (NARCL).

Bad loan reserves in Indian banking system increased after Bank The Government of India conducted an Asset Quality Review (AQR) in 2016. reserve Bank of India Identified loans that were in default but not recognized, and timed borrowers. Bad loans peaked at over 10% of all loans in March 2018 and have since declined following massive provisioning by banks. Ever since RBI conducted AQR, banks have made provisions of over Rs 16 lakh crore.

a separate report by Motilal Oswal The said new defaults will be controlled, leading to healthy recovery and upgradation as well as continuous improvement in asset quality in banks. It added that while the performance of restructured and government-guaranteed loans will need to be monitored, the overall credit cost is expected to remain under control, helping banks improve their balance sheets. The brokerage house has forecast a 40% growth in Q1FY23 profit for private banks and 6% for public sector banks.

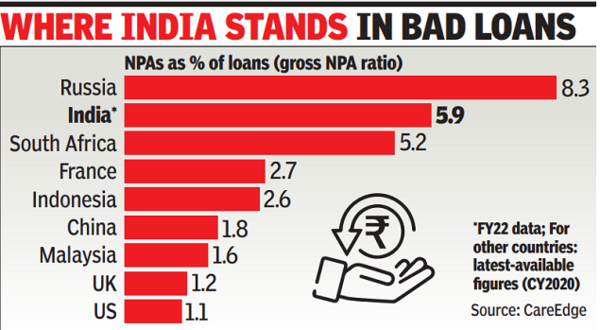

“Despite the steady decline, India has the highest NPA ratio among comparable countries. Non-performing loans in advanced economies eased due to continued deleveraging and institutional and government interventions,” said CareEdge.

RBI has projected improvement in bad loans to 5.3% under the baseline scenario by March 2023 after its stress tests. Although GNPA The ratio may increase in moderate/severe stress scenarios, and the GNPA ratio may increase to 6.2%/8.3%, respectively.

In terms of ratio, the Gross Non-Performing Assets account for the highest 9.4% for agriculture. “Agriculture GNPAs generally increased due to drought and elections – anticipation of loan waivers,” the Care Age report said. NPAs for industry stood at 8.4% and services at 5.8%. It was the lowest for retail, with home loans dominated at 1.8%. Debt restructuring by entities affected by the second wave of covid accounted for 1.6% of total advances in December 2021.