With this, Zomato will become the first online delivery company and also the first Indian unicorn startup to be listed on the exchanges.

The IPO is expected to increase the market valuation of Zomato to $9 billion.

With the stock markets experiencing record rallies due to an influx of investors, the company has chosen an opportune time to go public.

Moreover, the primary market is also in a spree with record issuance levels during the first half of the year and an already strong IPO for the next half.

Here’s why investing in the market could be a good option this year:

market share

Zomato’s core business-to-customer (B2C) offering mainly comprises of two segments – food delivery and dining.

In its draft Red Herring Prospectus (DRHP), the company said it has consistently gained market share over the past four years to lead the food delivery space in India.

The company has grown manifold over the years, with online orders growing 13.2 times from 30.6 million in 2018 to 403.1 million in 2020.

Rapid recovery from covid lows

In the first quarter of FY 2021, Zomato’s business was badly affected due to the Kovid-19 pandemic. Its food delivery business fell to its lowest in two financial years as a nationwide lockdown was imposed to contain the spread of the virus.

However, the company saw a strong recovery in the subsequent quarters and a significant increase in the number of online food orders.

The gross order value during Q3 was Rs 29,810 million – the highest achieved by the company in any quarter till December 2020.

growth in unit economics

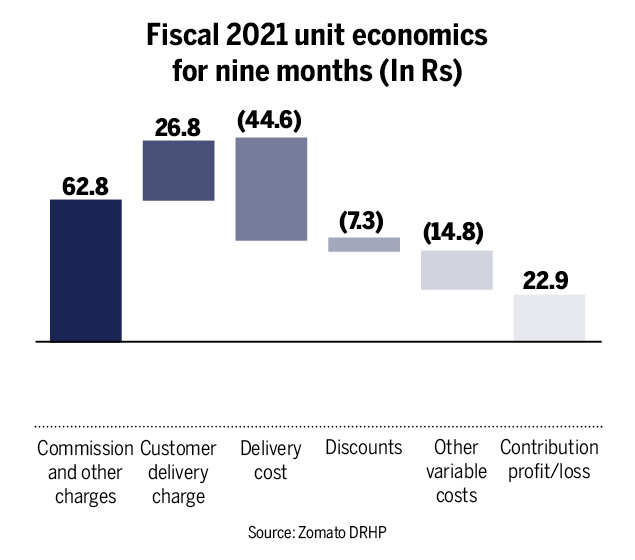

One of the biggest achievements for Zomato has been improving the unit economics of its food delivery segment.

Good unit economics means that Zomato is in a better stage of achieving its break-even point and making profit on every order placed by the user. This is what happens when Average Order Value (AOV) orders keep moving up and that’s exactly what happened during the pandemic.

For example, whenever an order is placed on Zomato it keeps a certain percentage of the order value as commission and sends the rest to the restaurant.

If it is spending Rs 5 in placing an order but earning Rs 6 through commission and delivery charges, it will be called positive unit economics.

To achieve this the AOV must be raised. AOV will only accelerate if customers regularly look for more expensive orders.

In the last seven quarters, Zomato’s AOV has steadily increased from Rs 265 in Q1 of FY20 to Rs 408 in Q3 of FY21.

IPO valuation higher than existing companies

The market capitalization of the first of its kind IPO is expected to be around Rs 60,000 crore.

Interestingly, this valuation is comparable to the combined market value of all quick service restaurants (QSRs).

This is more than the market value of all the shares taken together. The list includes the likes of Indian Hotels – which runs the Taj chain of hotels; and The Oberoi Hotel.

At present, there are about a dozen listed QSRs in India with a combined market value of over Rs 60,710 crore.

Where does Zomato stand among global peers?

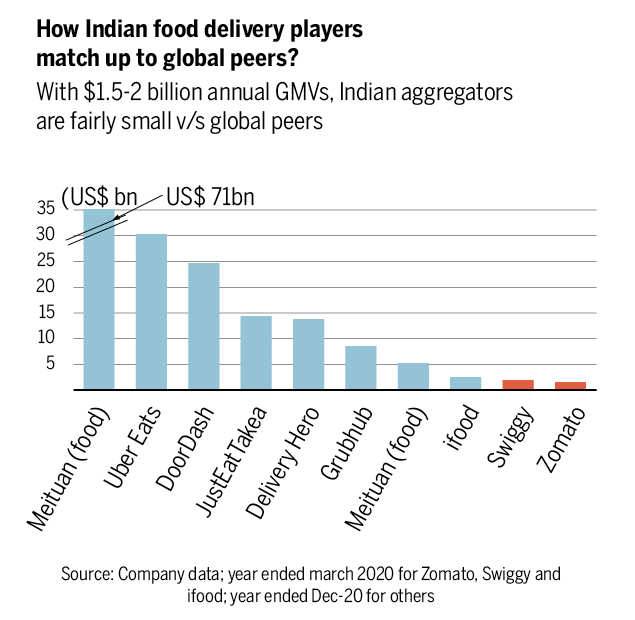

In terms of annual GMV comparison conducted by equity research firm Jefferies, Indian food delivery players lag far behind their global peers.

The chart below clearly shows that both the Indian companies Swiggy and Zomato are quite small in terms of GMV comparison.

It’s IPO!

India’s primary market is poised for a bonus of Rs 80,000 crore, with 30 companies already filing IPO documents to raise Rs 55,000 crore.

Around 10 more companies are in line for this month, and are trying to raise Rs 25,000 crore.

So far this year, the market has raised Rs 27,426 crore from 22 issues.

Companies are expecting to benefit from strong liquidity and a booming secondary market, which has seen a sharp increase in the number of new retail investors.

One IPO that every investor will be eyeing is India’s largest insurer Life Insurance Corporation (LIC). With the cabinet clearing the LIC disinvestment, its IPO launch is being considered as the biggest public issue in Indian corporate history.

Besides Zomato, other companies to hit the market this month include Glenmark Lifesciences, Windlass Biotech, Medi Assist TPA, Tattva Chintan Pharma, Paras Defense and Seven Island Shipping, which together are planning to raise Rs 13,650 crore.

stock markets added 142 lakh new investors

In the pandemic-stricken 2020-21, 142 lakh new individual investors joined the stock markets, indicating a significant increase in retail participation.

With the impact of the pandemic on the way of people’s savings amid low interest rates, the stock market has emerged as the top choice for investors.

Interest rates on various small savings schemes remained lower at 7.6 percent on Sukanya Samriddhi Yojana, 7.4 percent on Senior Citizen Savings Scheme, 7.1 percent on Public Provident Fund (PPF) and 6.8 percent on National Savings Certificate.

Interest rates on fixed deposits also remained low across banks with the largest lender in the last financial year state Bank of India (SBI) itself is offering interest rates ranging from 2.9 per cent to 5.4 per cent across the tenure.

All these led to an increase in retail participation in the stock market.

The BSE Sensex rose from 28,265 in early April 2020 to cross the 53,000 mark last month.

In the context of global competitors, the benchmark Sensex rose nearly 1.8 times last year, outperforming the markets of other major emerging economies, a report by SBI economists showed.

The market capitalization of Indian companies grew at the fastest pace despite the country facing a technical slowdown last year.

India IPO Market v/s Global Peers

According to a report by PricewaterhouseCoopers (PwC), India ranks fourth in terms of the number of IPOs launched during the first quarter of 2021 in the Asia-Pacific region.

It accounted for 8 percent of all IPO deals done in the Asia Pacific region and 3 percent of all global deals.

In terms of proceeds from IPOs, India ranks third behind only China and Hong Kong with earnings of $2.6 billion from issuances.

Globally, the first quarter of the financial year saw the strongest IPO activity in recent history. $202.9 billion from 727 IPOs issued in the first quarter of FY11.

Technology and Consumer Discretionary are issuing global IPOs, with the largest being Kuaishou Technology which raised $6.2 billion on the Hong Kong Stock Exchange, the report said.

In other words, the US market is dominated by IPO issuance, accounting for 68 percent of global earnings.

Relaxation in rules for listing of startups

Indian startups like Zomato, Paytm, Delhivery, MobiKwik, Nykaa and a few others are now eyeing to go public to raise funds, perhaps to make the best use of the market’s bullishness.

Earlier this year, Securities and Exchange Board of India (I myself) announced measures to make it easier for startups to go public on the Innovators Growth Platform (IGP).

For investors holding 25 per cent stake in such companies prior to listing, the shareholding period has been reduced to one year from two years earlier.

The pre-issue shareholding requirement has also been increased from 10 per cent to 25 per cent, encouraging large investors to fund startups.

Further, to migrate from IGP platform to BSE or NSE, a startup is first required to hold 75 per cent of its capital with Qualified Institutional Buyers (QIBs) – if it is eligible for other conditions like profitability, net worth, net worth fails to meet more. SEBI has now reduced this limit to 50 per cent.

The market regulator has also allowed alternative investment funds (AIFs) and angel investors to invest in startups.

.