Since SIP is a long-term wealth creation tool, the compounding effect can multiply in long-term investments.

Investing in Mutual Fund schemes through Systematic Investment Plan (SIP) mode helps in availing the benefits of compounding.

An often quoted quote is that Albert Einstein once said that compound interest is the eighth wonder of the world. Well, whether he said it or not is debatable, but the power of compounding with compound interest is a lesson for anyone who wants to understand the management of their personal finances.

Before getting into the ‘power’ of compounding, let us first understand what compound interest is.

Compound interest is interest on a deposit calculated on both the principal amount and the interest received over the period.

What is the ‘power’ of compounding?

With a range of investment options available, your chances of earning from your money have also increased. Investing even a small amount, such as SIP, has the potential to build a good pool of wealth over a period of time. However, when we are talking about saving money and earning interest on it, the factor that makes a difference is the method of compounding.

Compound interest, also known as ‘interest on interest’, refers to interest earned on the initial deposit (principal), including all accumulated interest.

Read also: SIP or Lump sum? Factors you should consider before investing

Along with the equity market, many schemes run by the government work on compounding based interest calculation.

Within the equity market, mutual funds can help you create substantial wealth over the long term, provided your investment decisions are timely and informed.

You keep adding the amount of interest earned on your savings back to the principal amount, and then the interest amount is calculated on the new principal amount (principal amount + interest earned). Now, since the principal amount keeps on increasing every year, your returns also keep on increasing. This is the power of compounding.

Simply put, compounding means that you get interest not only on the original principal amount, but also on the interest that keeps on adding to it.

Many investors underestimate or ignore the fact in their initial days of investing that the compounding effect is the prime accelerator to grow one’s wealth and build a sizable amount over time.

SIP and the power of compounding

Investing in Mutual Fund schemes through Systematic Investment Plan (SIP) mode helps in availing the benefits of compounding.

Since SIP is a long-term wealth creation tool, the compounding effect can multiply in long-term investments.

Read also: Confused about the types of mutual funds? What is Equity, Debt or Hybrid Fund; check details

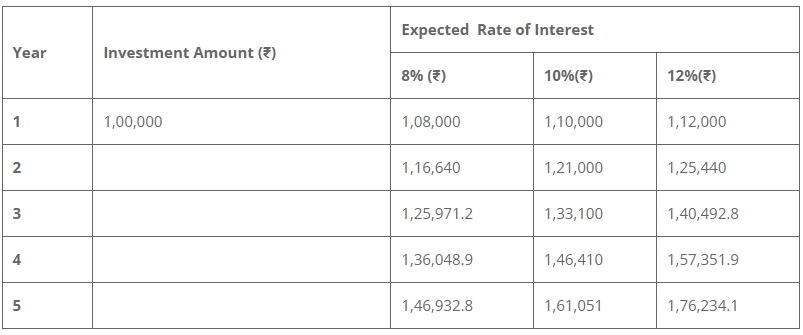

Motilal Oswal has given the following simple example on his website to demonstrate the power of compounding.

Raj and Rekha both put Rs 50,000 in an investment that pays an interest rate of 10% per annum for a period of ten years. Raj likes simple interest, while Rekha likes compound interest. Raj has a total of Rs. 1 lakh at the end of ten years. On the other hand, Rekha will be paid Rs. 1.30 lakhs.

This is because, in the Raj situation, interest was calculated only on Rs. 50,000 fundamentals. In the case of the line, however, the interest earned each year is added to the principle to calculate the next year’s interest. This increased his profits considerably.

read all latest business news Here