Suryoday Small Finance Bank is also offering an interest rate of up to 7 per cent to its savings account customers in the slab of Rs 5 lakh to Rs 2 crore.

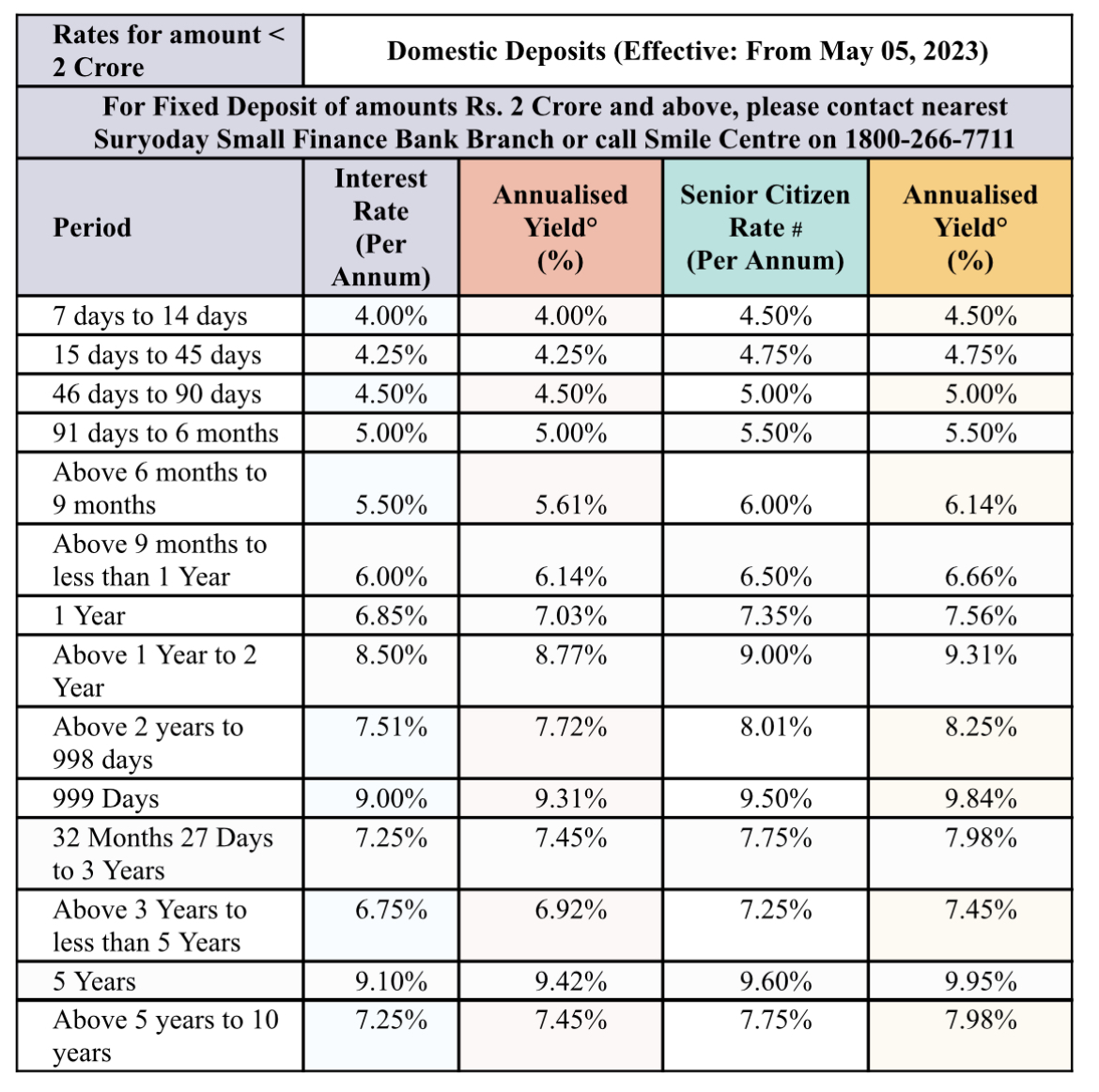

Suryoday Small Finance Bank is now accepting FDs below Rs 2 crore maturing in 7 days to 10 years at an interest rate of 4 per cent to 9.10 per cent for general public and 4.50 per cent to 9.60 per cent for senior citizens.

Suryoday Small Finance Bank (SSFB) has revised the interest rates on fixed deposits (FDs), effective Friday, May 5, 2023. Interest rates on deposits of less than Rs 2 crore with tenure of 1 to 5 years have been revised from 49. to 160 basis points (bps). After the latest hike, the bank is now accepting fixed deposits of less than Rs 2 crore maturing in 7 days to 10 years at an interest rate of 4 per cent to 9.10 per cent and 4.50 per cent to 9.60 per cent for general public. senior citizens.

“Regular customers can now get 9.10 per cent interest rate on 5-year deposits, while senior citizens can get 9.60 per cent interest rate. The bank is also offering an interest rate of up to 7 per cent to its savings account customers in the slab ranging from Rs 5 lakh to Rs 2 crore. This is the highest interest rate that the bank offers to its customers, also your deposits in this bank are backed by DICGC, making an investment decision soon will help you meet your 5 year mid term goals,” Suryoday Short Finance Bank said in a statement.

It said, “The minimum period for earning FD interest is 7 days. The rate applicable on premature withdrawal will be 1 per cent, whichever is lower of the two – the rate for the original/contracted tenor for which the deposit is booked (as on the date of booking the deposit); Rate for the actual period for which the deposit was with the bank (as on the date of booking the deposit).

The bank also said that since interest rates are subject to change without prior notice, depositors need to ascertain the rates on the value date of the FD.

read all latest business news, tax news And stock market update Here