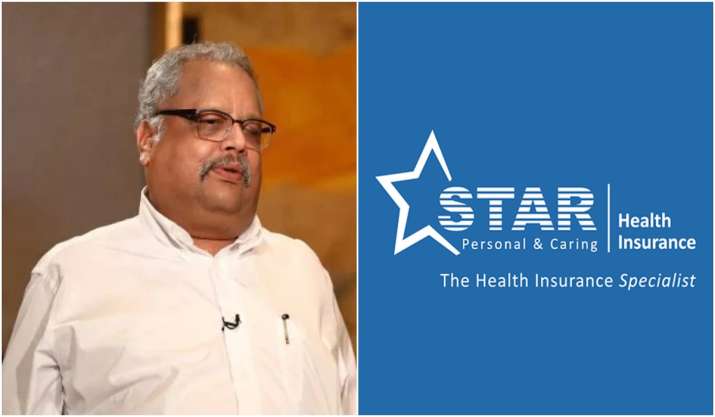

Star Health Insurance IPO: Price, GMP, Allotment Date; All About Rakesh Jhunjhunwala Backed Star Health IPO

Highlight

- Rakesh Jhunjhunwala-backed Star Health and Allied Insurance Company to open on November 30

- Investors can bid for a minimum of 16 equity shares and thereafter in multiples of 16 shares

- Public offering includes reservation of shares worth Rs 100 crore for employees

Star Health IPO SubscriptionRakesh Jhunjhunwala-backed Star Health and Allied Insurance Company is all set to launch its first IPO on Tuesday, November 30. The initial share sale is expected to fetch Rs 7,249.18 crore in which shares worth Rs 2,000 crore have been issued and there is an offer for the same. Sale (OFS) of 5.83 crore equity shares by multiple shareholders.

Star Health, the leading private health insurance company in the country, is owned by a consortium of investors like Westbridge Capital and Rakesh Jhunjhunwala.

Star Health Insurance IPO Subscription Date:

The bidding for anchor investors will open on November 29. The IPO will become available for bidding from 30 November 2021. The three-day initial public offering (IPO) will end on December 2.

Star Health Insurance IPO Price Band:

The price band of the IPO has been fixed at Rs 870-900 per equity share.

Star Health Insurance IPO Lot Size:

Investors can bid for a minimum of 16 equity shares and thereafter in multiples of 16 shares. Retail investors can invest a minimum of Rs 14,400 for a lot, and their maximum investment will be Rs 1,87,200 for 13 lots (208 equity shares).

Star Health Insurance IPO Allotment Date:

The tentative date for Star Health Insurance IPO share allotment is 7 December 2021.

Star Health Insurance IPO GMP:

Shares of Star Health & Allied Insurance Company fell in the gray market as its initial public offering drew to a close. Star Health Insurance’s IPO gray market premium has come down by over 50 per cent from ₹70 to ₹30 in the last three days.

Star Health Insurance IPO: Details

The IPO consists of a fresh issue of equity shares worth Rs 2,000 crore and an offer for sale of 58,324,225 equity shares by promoters and existing shareholders.

Promoters and promoter groups – Safecrop Investments India LLP, Konark Trust, MMPL Trust – and existing investors – Apis Growth 6 Ltd., MIO IV Star, University of Notre Dame du Lac, Mio Star, ROC Capital Pvt Ltd, Venkatasamy Jagannathan, Sai Satish and Bergis Meenu Desai.

The public offering includes reservation of shares worth Rs 100 crore for employees. About 75 per cent of the issue size is reserved for Qualified Institutional Buyers (QIBs), 15 per cent for non-institutional investors and the remaining 10 per cent for retail investors.

The equity shares of the company will be listed on BSE and NSE.

Read also | Cryptocurrency is here to stay, says Paytm founder Vijay Shekhar Sharma

,