Investing money and earning profit on it is an act that depends on how one takes the decision. From understanding the basics of the product/policy to the selection or availability of the budget becomes important. Even the payment methods play an important role in your financial planning.

Systematic Investment Plan (SIP) is one such method that has gained popularity among investors, especially young first-time retail investors, who want to secure their retirement or who have goals like owning a house or higher education.

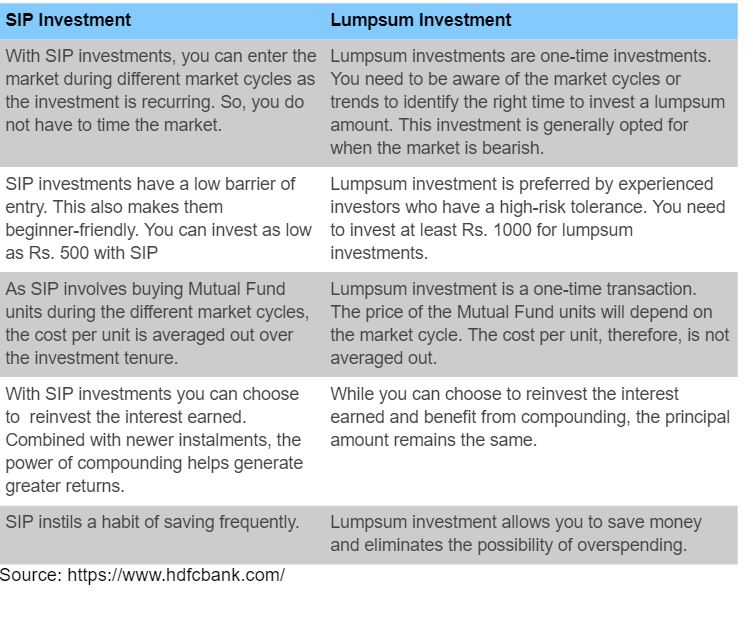

Not only SIP, another common method is ‘Lumpsum’. Mutual fund investors are faced with this choice-cum-confusion when they start an investment plan.

Both methods are useful for investors in different situations. Factors like the type of fund, amount to be invested, current market conditions can determine your approach to how you invest your money.

SIP or lumpsum investment in mutual funds comes in handy in various situations. In short, depending on your pocket, choose to invest through SIP or lump sum.

What is the difference between SIP and Lump Sum?

Lump sum is a one-time investment by a fund buyer when there is sufficient disposable amount in hand.

A lump sum investment is the entire amount at one go. For example when one gets windfall benefits in the form of bonus, leave encashment or others.

Read also: How to protect your hard earned money from online frauds?

In SIP, you can invest in Mutual Funds in a phased manner, where you regularly invest a small amount, say as low as Rs.500 monthly. Invest in a disciplined manner without worrying about market volatility and market timing.

Rahul Jain, Chairman and Head, Nuwama Wealth (formerly known as Edelweiss Securities) said, “SIP is a convenient and effective investment method to build wealth using equity funds. On a specified date, the money is transferred to the humanitarian A fund invests automatically without intervention, thus eliminating the role of ‘noise’ and fear in investing, which is the biggest deterrent to wealth creation.”

However, the choice of investment avenue should depend on your short term and long term goals. Important factors such as monthly income, financial stability, investment goals and risk-appetite should be considered before choosing any mutual fund.

It is to be noted that the returns generated from investments, whether lump sum or through SIPs, depend on the market conditions. If the market is rallying, a lump sum investment with the benefit of compounding can prove to be more profitable. On the other hand, if the trend is bearish or volatile, SIPs with rupee-cost averaging can be more beneficial.

However, investors should understand that markets are unpredictable, no one can tell when it is going to go up or down or when a bullish or bearish cycle will begin or end.

It cannot be said that lump sum investment can potentially generate higher returns than SIP or vice versa. Therefore, it is important to build a well-diversified portfolio that aligns with your goals and risk appetite.

Rise of SIP

There has been a rise in acceptance of SIP as a tool to create wealth in the long run.

“Left on their own, investors try to time the market to perfection, thus missing out on investment opportunities. Investors should plan for long term goals with SIP and continue with it till the goal is met.”

According to the Association of Mutual Funds in India, by December 2022, Mutual Fund SIP Account 6.12 crores and the total collected through SIP during December 2022 is Rs.13,573 crores.

The current rate of inflow is expected to continue in 2023, with experts suggesting that monthly SIPs will reach around Rs 14,000 crore on an average.

Investors should note that mutual funds are subject to market risk and are advised to read all scheme related documents carefully before investing.

read all latest business news Here