Pay-as-you-drive policy allows buyers to set a mileage limit for their car and offers them a discount on the normal premium. Lower the limit, higher will be the exemption on normal premium. Insurance is valid only to the extent chosen by buyer, An insurance company offers three slabs of 7,500 km, 5,000 km and 2,500 km.

Insurance companies may also offer discounts based on the quality of the driving. A telematics device is fitted in the car to monitor the vehicle condition and the user’s driving habits. This data is then interpreted to discount careful drivers. It can also penalize negligent and careless drivers.

These developments are good news for those who have multiple vehicles or who are not driving a lot due to the COVID restrictions. If their vehicles are not being heavily used, they will not have to pay the full premium. “The introduction of these options will help in increasing the reach and reach of the much needed motor own damage cover in the country,” IRDA said in a statement.

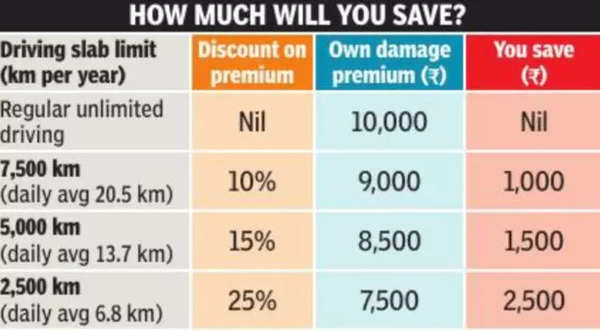

However, the discount offered on premium is not very exciting (see table). If you choose the 7,500 km slab, you get only 10% discount on the regular premium. Note, the discount is applicable only on ‘Own Damage’ premium, and mandatory third-party premiums and other add-on covers are not affected.

The discount is a bit more attractive for the lower limit of 2,500 km, but it works out to an average drive of less than 7 km in a day. Consider this before opting for a low slab policy.

The good news is that buyers can switch to a higher slab or even a regular unlimited policy if they are driving over the slab limit. But this upgrade should be done well ahead of time. It is not possible to upgrade after an accident or claim event.

The installation of telematics devices also raises privacy concerns for the car owner. No doubt this will lower the insurance premium, but this discount comes at a price. Go for it only if you are comfortable with the idea that the insurer will have 24×7 data on your car movement.