The Reserve Bank of India (RBI) on Wednesday raised the benchmark lending rate by 35 basis points to 6.25 per cent to contain inflation, which has remained above the tolerance level for the last 11 months.

With the latest hike, the repo rate or the short-term lending rate at which banks borrow from the central bank has now crossed 6 per cent. This is the fifth consecutive increase after an increase of 40 basis points in May and 50 basis points each in June, August and September. Overall, the RBI has increased the benchmark rate by 2.25 per cent since May this year.

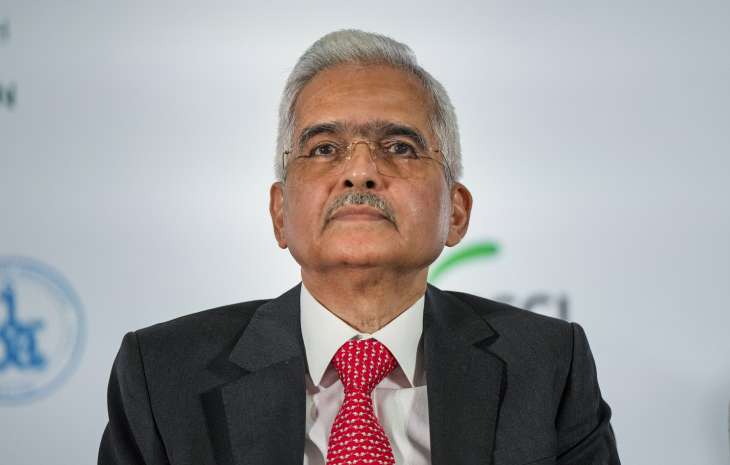

The six-member Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das took the decision in favor of a rate hike with a majority.

Consumer Price Index (CPI)-based inflation, which the RBI takes into account while setting its benchmark rate, stood at 6.7 per cent in October. Retail inflation has remained above the RBI’s comfortable level of 6 per cent since January this year. Das retained the inflation forecast for the current fiscal at 6.7 per cent.

The RBI has slashed its GDP growth forecast for the current fiscal to 6.8 per cent from the earlier estimate of 7 per cent. In its last bi-monthly policy review released in September, the RBI had slashed the economic growth forecast for the current fiscal to 7 per cent from the earlier 7.2 per cent owing to expanded geopolitical tensions globally and accommodative monetary policy.