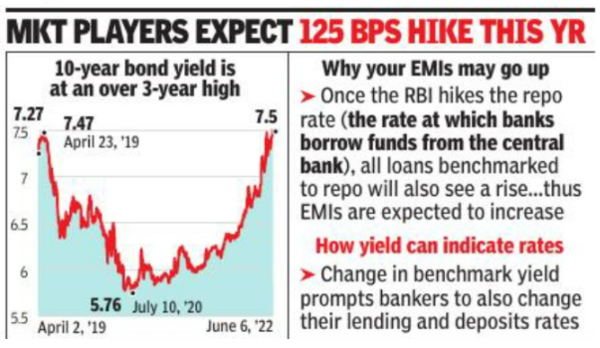

A change in the benchmark yield prompts bankers to change their lending and deposit rates accordingly. The spike in yield came even when reserve Bank of IndiaThe interest rate setting committee began its three-day meeting on Wednesday morning with expected results.

Last month, RBI Governor Shaktikanta Das had said that expectations of a rate hike in June’s policy meeting were a ‘no brainer’. Bankers expect an increase of up to 50 basis points (100 bps = 1 percentage point) after 40 bps in early May.

Bond market players, however, expect rates to rise further in the next few months, mainly to tide over rising inflation. With the rise in crude oil prices, the prices are likely to rise further in the coming months. On Monday, Brent crude was hovering near its 14-year high at $120 a barrel.

Bond market players said petrol, diesel and LPG prices in India may rise due to rise in global crude oil prices. Since the government recently sharply cut duties on petro products, mainly to check inflation, there will be no scope for further cuts if crude oil prices continue to rise. This in turn can increase inflation in India.

To prevent a rapid rise in prices, the RBI may raise interest rates more rapidly so that people have less money to spend. But rising interest rates will definitely lead to higher EMIs, he said. Recently, loans from a large number of banks, housing finance companies and NBFCs have been benchmarked to the repo rate, which is set by the central bank. Once the RBI raises the repo rate (at which banks borrow money from it), all loans benchmarked to this rate will also go up.

A debt fund manager said that the cut-off yield on June 1 is 364 days. treasure Bills auction was 6.08%, which came as a big surprise to the market players. The last time such a high yield was seen for T-bills, the repo rate was 5. 75%. In comparison, the current repo rate is 4.40 per cent. Therefore, the bond market is expecting the RBI to increase the rate by around 125 bps in the next few months. “This is indicative of a higher policy rate tightening by RBI in upcoming reviews,” the fund manager said.

Bond dealers further pointed out that government bond yields are also rising rapidly in many developed markets, prompting foreign fund managers to withdraw money from India and invest in those markets. Besides, selling of bonds in local markets is strengthening yields here, he added. Bond yields and their prices are inversely related.