In FY21, the share of US in remittances was 23.4%, while that of the UAE was 18%. “Flows from North America and Europe are primarily driven by individuals operating in the service sector and hence depend on macroeconomic conditions of the underlying countries,” said a research report by Axis Mutual Fund. In the MENA region, oil prices fuel a construction and tourism boom when they rise, increasing the demand for labour.

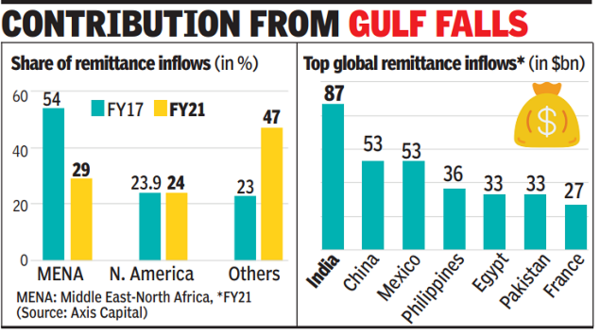

In FY17, the Middle East North Africa (MENA) region accounted for 53% of total remittances to India. The region’s share dropped to 28.6% in FY21, the share of MENA in remittances dropped to 28.6%, while North America rose marginally to 24% from 23.9% in FY17.

While NRIs in the gulf region largely remit their money to public sector banks, the North American NRIs largely use private banks (and MNCs) to send money. As a result, the share of private banks in NRIs has risen to 53% overtaking public sector banks with the remaining 47%.

According to the report, the widespread perception that a major chunk of India’s NRI population hail from Kerala is only partly true and is likely to change. Rising wages in the southern states have resulted in a drop in emigration. Nearly 50% of emigration cleared by the Ministry of External Affairs in 2020 was from Northern states like Uttar Pradesh, Orissa, Bihar and West Bengal.

“The role of remittances in GSDP is already falling in states like Kerala (7.5% as of FY21) and Karnataka, whereas it is rising in Northern states. Significant rise in remittance % of GSDP in Maharashtra and Delhi could be support to families given severe Covid impact and the GSDP itself falling drastically during FY21,” the report said.