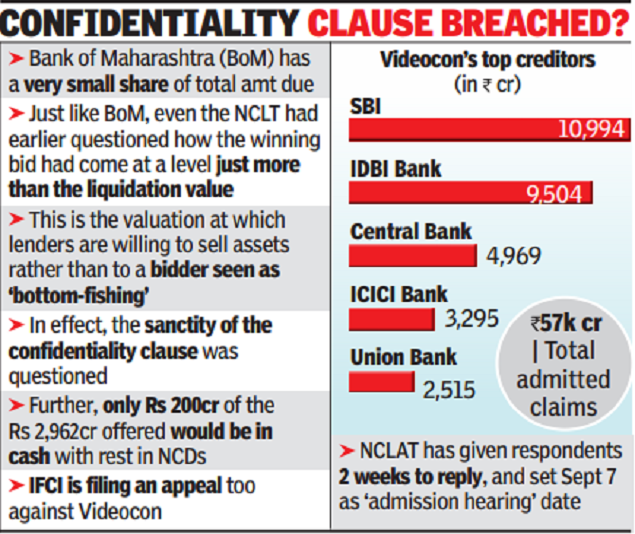

BoM had raised two main objections – the sale price was close to the liquidation price, and even 4% was being paid which was largely in the form of debentures with very little cash. IFCI is understood to have filed a separate appeal. against videocon

The NCLT, while approving the resolution plan on June 8, had raised questions regarding the sale, pointing out that the applicant was paying almost nothing and questioned how the bid had come marginally above the liquidation price. Lenders are expected to maintain utmost secrecy regarding the liquidation value. This is the price below which they would sell the asset to the company rather than sell it to a bottom-fishing bidder.

The NCLT had raised doubts over the compliance of confidentiality norms in the case and requested the Insolvency and Bankruptcy Board of India to investigate the issue. In the context of bankruptcy laws, the decision of the committee of creditors is considered supreme and the NCLT usually approves the deal as long as the process is followed.

Typically, a dissatisfied creditor loses because they receive their share based on the liquidation value rather than the sale price. In the present case, the liquidation price and the selling price are almost equal and BoM should have got the same share as the other creditors. However, the PSU lender has broken ranks from its peers as the resolution plan sought to pay disgruntled creditors with non-convertible debentures (NCDs). The counsel for BoM argued that what the bank would receive would be less than the liquidation value of the company.

As per the plan presented by Twin Star, of the Rs 2,962 crore offer, only Rs 200 crore will be paid in cash and the rest will be paid in NCDs. Twin Star had proposed to issue NCDs with a face value of Rs 2,700 crore. The NCDs will be redeemed in 5 installments – the first installment of Rs 200 crore will be 25 months from the closing date of the transaction, the balance amount will be repaid in installments of Rs 625 crore in three, four, five and six years from the closing date. There will be a coupon of 6.65% payable annually on the outstanding NCDs.

In its order, the appellate body has given two weeks to the respondents to respond and has listed the appeal for an ‘admission hearing’ on September 7. The company will continue to be managed by a resolution professional under the bankruptcy process.

.