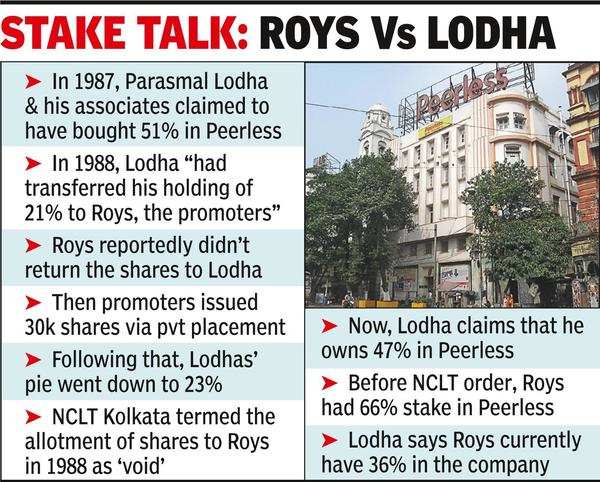

TOI on Thursday reported that NCLT termed allotment of shares to Roys in 1988 as ‘void’ in its order on July 18, 2022.

When contacted, Roy informed TOI that the order which has come is nothing however a stage of litigation. “The order is topic to problem, which we will actually do, and we’re assured that the ultimate verdict from the upper discussion board will go in our favour. God’s Divine Grace and blessings of the folks have at all times been with us. Fact will prevail,” he added. S Okay Roy, father of Jayanta Roy, was the MD of Peerless for over 20 years.

Lodha informed TOI that following the order he has 47% in Peerless in comparison with 36% owned by the Roy household. “Earlier than the order, the promoters had 66% stake in Peerless,” he stated.

Lodha claimed that manner again in 1987, Roys had approached him to purchase a stake in Peerless as the corporate was in very dangerous form. “I purchased 51% stake in Peerless and out of this, I saved 21% in my identify and 30% was registered within the identify of Poddar Tasks, Tuhin Kanti Ghosh and R L Gaggar. I used to be purported to take one other 25% from Roys.”

Lodha claimed that in 1988, after being caught in a political turmoil, he had transferred his private holding of 21% to Roys. “When my disaster was over, Roys refused at hand over the shares transferred to them. Later, the promoters issued 30,000 shares on a non-public placement foundation and the means adopted for this was unfair. Following this, my shareholding (within the identify of three others) went all the way down to 23%. NCLT has appointed a particular officer and inside a month, a brand new shareholding record needs to be issued,” he added.

Lodha claimed that he has the single-largest chunk of Peerless, whereas for 10% share, there isn’t a claimant and the remaining 7% is scattered.