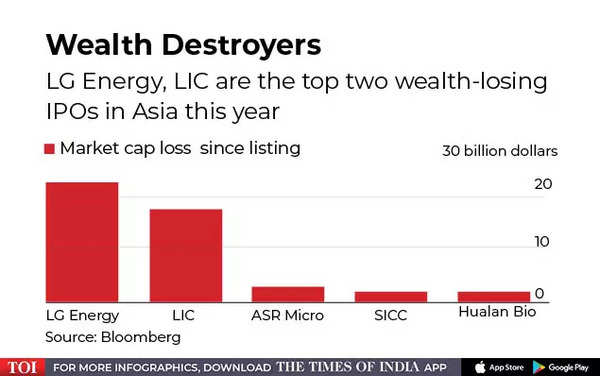

India’s biggest IPO of all time ranks second in terms of loss of market capitalization since listing, after a 29% drop since the beginning of May 17, according to data compiled by Bloomberg. The drop puts it just behind South Korea’s LG Energy Solutions Ltd., which saw its share price drop more than 30% for the first time since its initial spike.

Almost a month after listing, LIC’s $2.7 billion IPO has turned out to be one of Asia’s biggest new stock flops this year, as rising interest rates and inflation levels hit share selling demand globally And India’s stock market is facing unprecedented selling pressure by foreigners. The benchmark S&P BSE Sensex is down over 9% this year.

Shares of LIC are set to fall for the 10th consecutive session after the mandatory lock-up period for anchor investors ended on Friday, slipping up to 5.6% on Monday. The route has worried the government, with officials saying the company’s management will “look into all these aspects and enhance shareholders’ value.”

LIC’s long-delayed IPO was dubbed India’s “Aramco moment” in the context of bay Oil giant Saudi Arabian Oil Company’s listing in 2019 for $29.4 billion, the world’s largest. it was part of the prime Narendra ModiThere are plans to expand the capital market of the country. The share sale, which was oversubscribed by nearly three times, was aimed at bridging the government’s budget deficit following an increase in spending during the pandemic.

According to Avinash Gorakshakar, head of research, discount brokerage Profitmart Securities Pvt Ltd, there could be further pain for the stock given the weak quarterly results. “Management’s communication with investors is confusing. They haven’t done an analyst call after the results,” he said. “So there’s no clarity on how the company plans to grow, what its strategy is going to be.”