Government is introducing a new digital payment mode under is i Is known e-rupee. This new payment mechanism aims to ensure that the government can provide monetary assistance directly to citizens in a “leak-proof manner” in the form of prepaid e-vouchers powered by UPI. It can be thought of somewhat like a ‘Sodexo coupon’ that the government will give directly to citizens, so that they can use it without having access to online banking, payment apps or other traditional payment modes.

With e-RUPI, it can be expected that the ‘unbanked’ section of our society will easily get financial assistance for health services, child welfare, medicines, fertilizer subsidy and much more.

What is e-rupee? And what’s new

The new digital payment mode–e-RUPI– is basically a prepaid voucher that can be issued directly to citizens after verifying the mobile number and identity. Instead of putting cash in one’s bank account, a prepaid e-RUPI voucher will be delivered to the beneficiary’s mobile number in the form of a QR code or SMS string-based e-voucher.

This QR code or SMS voucher can be used only once in the name of which it is issued. The beneficiary can redeem the voucher without having the card, digital payment app or internet banking access with the service provider. Also, payment can be processed only after the service is rendered to the beneficiary.

The biggest advantage is that using this service does not require using an app or having access to internet banking. Hence, any person having any type of mobile phone having valid phone number can walk-in with e-RUPI SMS or QR code to avail the service. Also, since it is a prepaid voucher, the beneficiary already has access to the money when required. There is no physical interface by anyone in the payment process and the entire transaction is digital, cashless and contactless.

What are the services covered under e-RUPI?

The government wants to use e-RUPI as “leak-proof delivery of welfare services”, which can be used to provide medicines and nutritional support under maternal and child welfare schemes, TB eradication programmes, medicines and diagnostics under schemes. for providing services under the schemes. Like Ayushman Bharat Pradhan Mantri Jan Arogya Yojana, Fertilizer Subsidy and many more.

Corporates can also use e-RUPI for employee benefits

The private sector can use e-RUPI vouchers as part of their employee welfare and corporate social responsibility programmes. Your office can issue e-RUPI vouchers to cover travel, food, health care etc. The concept is similar to how coupons and meals work in your office.

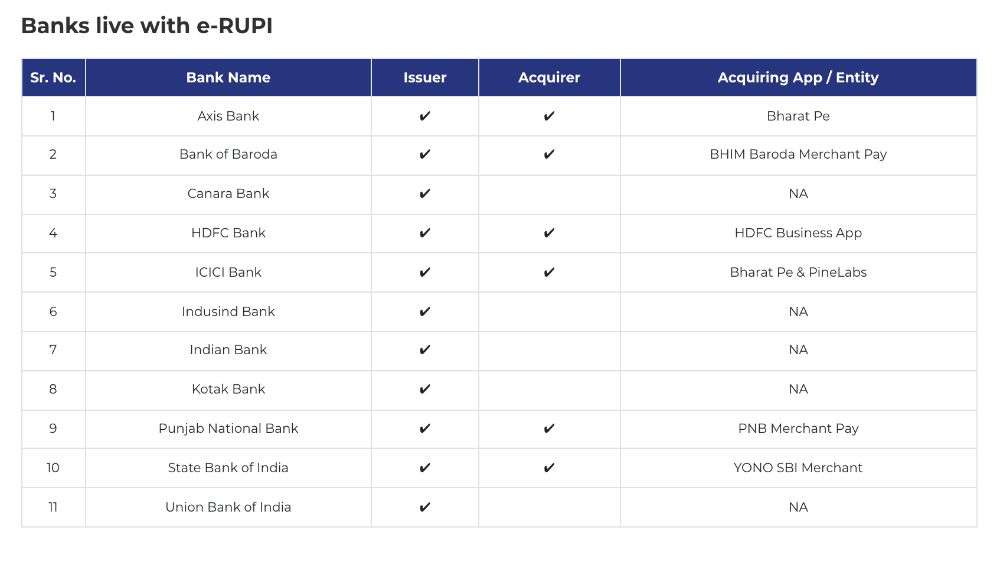

Which banks are supporting e-RUPI

Currently, 11 banks are supporting e-RUPI. Note that some banks can only issue e-RUPI vouchers but cannot accept them. Thankfully, Major Banks Prefer state Bank of India, ICICI Bank, HDFC Bank, Punjab National Bank and others are fully supporting e-RUPI for issuing e-RUPI coupons as well as for redeeming them.

Banks which are fully supporting e-RUPI: State Bank of India, ICICI Bank, HDFC Bank, Punjab National Bank, Axis Bank and Bank of Baroda.

Banks that will issue e-RUPI Coupons only: Canara Bank, IndusInd Bank, Indian Bank, Kotak Bank and Union Bank of India.

With e-RUPI, it can be expected that the ‘unbanked’ section of our society will easily get financial assistance for health services, child welfare, medicines, fertilizer subsidy and much more.

What is e-rupee? And what’s new

The new digital payment mode–e-RUPI– is basically a prepaid voucher that can be issued directly to citizens after verifying the mobile number and identity. Instead of putting cash in one’s bank account, a prepaid e-RUPI voucher will be delivered to the beneficiary’s mobile number in the form of a QR code or SMS string-based e-voucher.

This QR code or SMS voucher can be used only once in the name of which it is issued. The beneficiary can redeem the voucher without having the card, digital payment app or internet banking access with the service provider. Also, payment can be processed only after the service is rendered to the beneficiary.

The biggest advantage is that using this service does not require using an app or having access to internet banking. Hence, any person having any type of mobile phone having valid phone number can walk-in with e-RUPI SMS or QR code to avail the service. Also, since it is a prepaid voucher, the beneficiary already has access to the money when required. There is no physical interface by anyone in the payment process and the entire transaction is digital, cashless and contactless.

What are the services covered under e-RUPI?

The government wants to use e-RUPI as “leak-proof delivery of welfare services”, which can be used to provide medicines and nutritional support under maternal and child welfare schemes, TB eradication programmes, medicines and diagnostics under schemes. for providing services under the schemes. Like Ayushman Bharat Pradhan Mantri Jan Arogya Yojana, Fertilizer Subsidy and many more.

Corporates can also use e-RUPI for employee benefits

The private sector can use e-RUPI vouchers as part of their employee welfare and corporate social responsibility programmes. Your office can issue e-RUPI vouchers to cover travel, food, health care etc. The concept is similar to how coupons and meals work in your office.

Which banks are supporting e-RUPI

Currently, 11 banks are supporting e-RUPI. Note that some banks can only issue e-RUPI vouchers but cannot accept them. Thankfully, Major Banks Prefer state Bank of India, ICICI Bank, HDFC Bank, Punjab National Bank and others are fully supporting e-RUPI for issuing e-RUPI coupons as well as for redeeming them.

Banks which are fully supporting e-RUPI: State Bank of India, ICICI Bank, HDFC Bank, Punjab National Bank, Axis Bank and Bank of Baroda.

Banks that will issue e-RUPI Coupons only: Canara Bank, IndusInd Bank, Indian Bank, Kotak Bank and Union Bank of India.

Who has created e-RUPI?

The entire digital payments ecosystem in India has come together to enable e-RUPI. National Payments Corporation of India (NPCIE-RUPI has been launched in association with Department of Financial Services (DFS), National Health Authority (NHA), Ministry of Health and Family Welfare (MoHFW) and 11 associate banks.

.