The tax cut is pushing pump rates across the country to their highest levels after a steady rise in international oil prices.

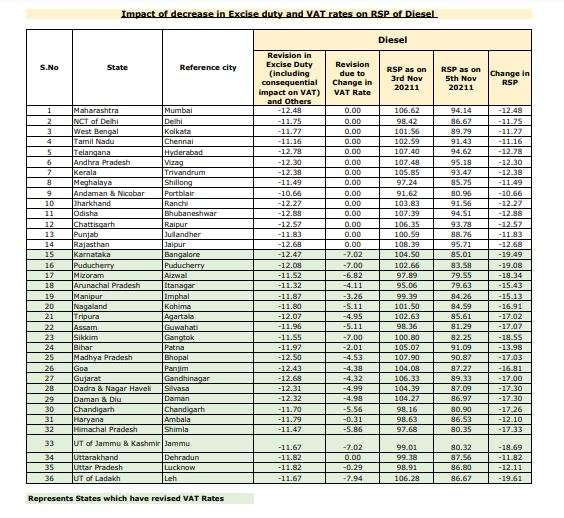

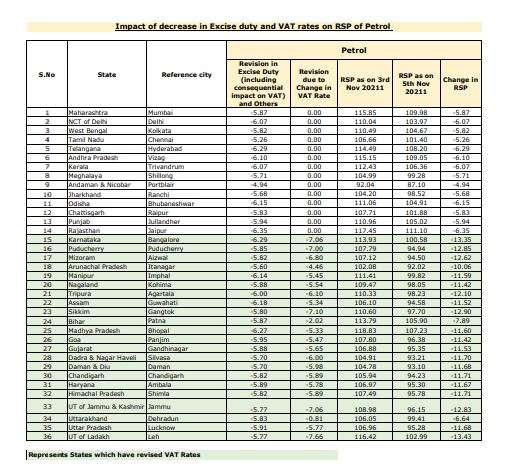

Following the Centre’s decision to reduce excise duty on petrol and diesel by Rs. 5 and Rs. 10 respectively, the central government said in an official release that 22 states have so far reduced VAT on petrol and diesel, and 14 have not.

Karnataka has seen the maximum reduction in petrol prices, followed by Puducherry and Mizoram. The release further said that petrol prices in these states have come down by Rs 13.35, Rs 12.85 and Rs 12.62, respectively.

In the case of diesel, the maximum cut has been made by Karnataka, bringing down prices by Rs 19.49 per litre, followed by Puducherry and Mizoram.

revised rates

revised rates

Read also | Center should release GST compensation to states to reduce VAT on fuel: Sharad Pawar

The tax cut is pushing pump rates across the country to their highest levels after a steady rise in international oil prices.

While petrol reached above Rs 100 per liter in all major cities, diesel had crossed that level in more than one and a half dozen states.

The total increase in petrol price since the government’s decision to hike excise duty to a record level on May 5, 2020 was Rs 38.78 per litre. During this, the price of diesel has increased by Rs 29.03 per liter.

The continued rise in fuel prices was strongly criticized by opposition parties, particularly the Congress, which demanded the government to reduce its excise duty.

Based on the April-October consumption data, the cut in excise duty will result in a revenue loss of Rs 8,700 crore per month to the government. Industry sources said this totals to an annual impact of over Rs 1 lakh crore. For the remainder of the current financial year, the impact would be Rs 43,500 crore.

Data available from the Controller General of Accounts (CGA) in the Union Finance Ministry shows that excise duty collection rose to Rs 1.71 lakh crore during April-September 2021, from Rs 1.28 lakh crore in the same period of the previous fiscal. .

For the entire 2020-21 financial year, excise duty collection stood at Rs 3.89 lakh crore and in 2019-20 at Rs 2.39 lakh crore, CGA data showed.

After the introduction of the Goods and Services Tax (GST) regime, excise duty is levied only on petrol, diesel, ATF and natural gas. All other goods and services are under the GST regime.

Minister of State for Petroleum and Natural Gas Rameshwar Teli had told Parliament in July that the central government’s tax collection on petrol and diesel increased by 88 per cent to Rs 3.35 lakh crore as of March 31, 2021 (financial year 2020-21). 1.78 lakh crore a year ago.

Excise duty collection in pre-pandemic 2018-19 was Rs 2.13 lakh crore.

Read also | Petrol, diesel prices cut across the country, Center cuts excise duty, states reduce VAT. description

Read also | Petrol price cut by Rs 6.07 in Delhi, Rs 11.75 per liter in diesel

.