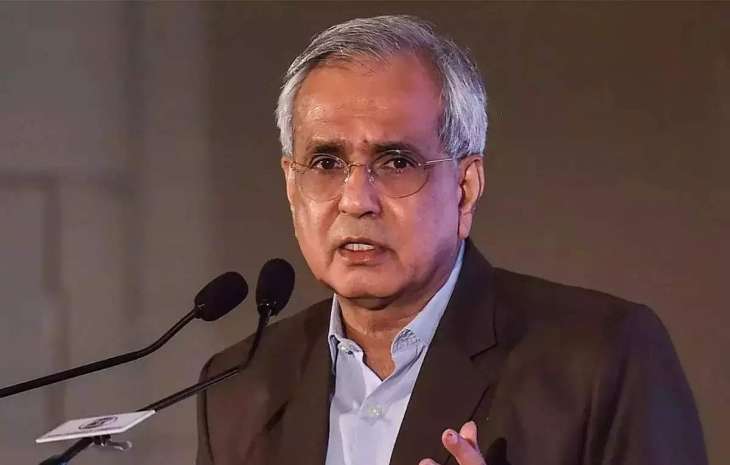

India is likely to grow at 6 per cent in the next fiscal due to several reforms undertaken by the Narendra Modi government during the last eight years, former NITI Aayog vice-chairman Rajiv Kumar said on Sunday, making the country a high-growth country. Could stay.

which will accelerate the development of India

Kumar further said that a simultaneous slowdown in the North American and European economies would pose major risks going forward.

He said in an interview to PTI-language, “India has a good chance of continuing with the high growth rate because of the reforms done during the last eight years. We will be able to achieve 6 percent growth in 2023-24.” Will be successful.”

According to Kumar, there are several downside risks, especially in the context of the uncertain global situation.

“These have to be tackled through careful policy measures designed to support our export efforts as well as improve the flow of private investment from domestic sources as well as foreign sources,” he added.

The Reserve Bank has projected India’s economic growth at 6.4 per cent for 2023-24, which is broadly in line with the projections of the Economic Survey tabled in Parliament.

Office for National Statistics forecast

According to the first advance estimates of the National Statistical Office (NSO), the gross domestic product (GDP) growth rate in 2022-23 is estimated to be 7 per cent.

The Economic Survey 2022-23 has projected a baseline GDP growth of 6.5 per cent in real terms for the next financial year.

How will inflation increase?

Responding to a question on high inflation, Kumar said the Reserve Bank has said it will ensure that the rate of inflation is brought under control.

“At the same time, a good winter harvest will help keep food prices low,” he added.

RBI reduced the forecast for consumer price inflation (CPI) to 6.5 per cent from 6.7 per cent for the current financial year. India’s retail inflation stood at 6.52 per cent in January.

Responding to a question on India’s growing trade deficit with China, Kumar suggested that New Delhi should re-engage with Beijing to find greater opportunities and access to China’s market.

He asserted, “There are many products that India can export more to China. This will require a well-thought-out re-engagement.”

According to Kumar, it would be possible for India to restrict imports from China as most of the imported products are essential imports.

Indian and Chinese troops clashed along the Line of Actual Control (LAC) in Arunachal Pradesh’s Tawang sector on December 9, 2022 and the face-off resulted in “minor injuries to some personnel on both sides”.

According to recent data released by Chinese customs, trade between India and China is set to touch an all-time high of USD 135.98 billion in 2022, while New Delhi’s trade deficit with Beijing is set to exceed USD 100 billion for the first time despite bilateral ties crossed the figure of ,

Responding to a question on the Adani crisis, Kumar said a strong public-private partnership is necessary for infrastructure development at the required rate.

“I don’t think an incident like this with a private family company will deter that effort… There are a large number of private sector companies that have participated in infrastructure development in the past and continue to do so.” Will keep.” “He saw.

The Adani group has been under severe pressure ever since US short-seller Hindenburg Research on January 24 alleged accounting fraud and stock manipulation, allegations the group described as “malicious”, “baseless” and a “systematic attack on India”. I have denied. ,

While the listed companies of the group lost over USD 125 billion in market value in three weeks, opposition parties inside and outside Parliament attacked the BJP government for the port-to-energy group’s meteoric rise. Shares of most of the group companies have recovered in the last few days.

(with PTI inputs)