According to Chainalysis, in India, where households hold more than 25,000 tonnes of gold, investments in crypto grew from about $200 million in the last year to nearly $40 billion. This is despite outright hostility towards the asset class from the central bank and the proposed trading ban.

32-year-old entrepreneur Richie Sood is one of those who switched from gold to cryptocurrency. Since December, he has put in just 1 million ($13,400) – some of it borrowed from his father – in bitcoin, dogecoin and ether.

And she has been lucky with her timing. When Bitcoin broke to $50,000 in February and bought back after its recent decline, it redeemed part of its position, allowing it to fund the overseas expansion of its education startup StudyMate India.

“I would rather invest my money in cryptocurrency than gold,” Sood said. “Crypto is more transparent than gold or assets and yields higher returns in a shorter period of time.”

He is part of a growing number of Indians – now over 15 million in total – buying and selling digital coins. This is catching up with 23 million merchants of these properties in the US and compares with only 2.3 million in the UK.

The co-founder of India’s first cryptocurrency exchange says that the growth in India is coming from an 18-35 year old group. The latest data from the World Gold Council indicates that Indian adults under the age of 34 have a lower appetite for sleep than older consumers.

“They find it far easier to invest in crypto than gold because the process is much simpler,” said Sandeep Goenka, co-founder zebpe and spent years representing industry in discussions with the government on regulation. “You go online, you can buy crypto, you don’t have to verify it, unlike gold.”

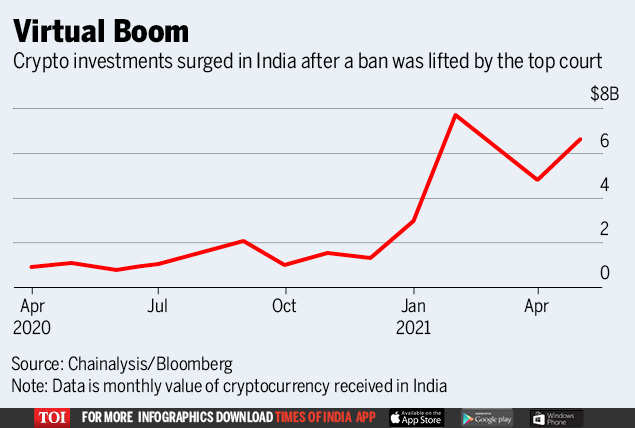

One of the biggest obstacles preventing widespread adoption is regulatory uncertainty. Last year, Supreme court A 2018 rule banning crypto trading by banking entities was repealed, resulting in a boom in trading.

However, the authorities have shown no signs of adopting cryptocurrencies. The country’s central bank says it has “major concerns” about the asset class and six months ago the Indian government proposed a ban on the trading of digital coins – although it has remained silent on the subject ever since.

“I am flying blind,” said Sood. “I have a risk appetite, so I’m willing to take the risk of a ban.”

However, official animosity has meant that many large individual investors are reluctant to talk openly about their holdings. A banker Bloomberg spoke to who has invested over $1 million in crypto assets said that there is currently no clear income tax rule if he is publicly known to be a big-ticket crypto investor. So they were concerned about the possibility of a retrospective tax raid.

They already have contingency plans in place to move their business to an offshore Singapore bank account if sanctions were to be imposed.

To be sure, the value of Indian digital asset holdings remains a part of its gold market. Still, the growth is clear, especially in trading – the four largest crypto exchanges saw daily trading up to $102 million from $10.6 million a year ago, according to CoinGecko. According to Chainalysis, the country’s $40 billion market is well behind China’s $161 billion.

For now, rising adoption is yet another sign of Indians’ willingness to take risks within a consumer finance sector that has been plagued by instances of regulatory laxity.

“I think over time everyone is going to adopt it in every country,” said 22-year-old Kenneth Alvares, an independent digital marketer who has invested over $1,300 in crypto so far. “Right now the whole thing is scary with regulation but that doesn’t worry me because I don’t plan on removing anything right now.”

.