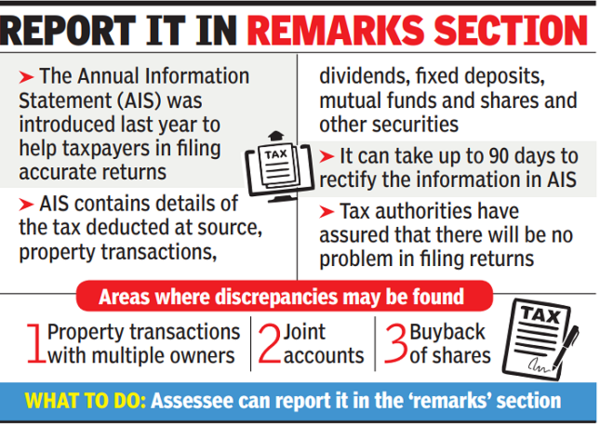

The Annual Information Statement (AIS), which was introduced last year, contains information on tax deduction at source, property transactions, dividends, fixed deposits, mutual funds and shares and other securities, aggregated from multiple sources on your basis. pan, It aims to help the taxpayers in the formation available with the government and enable them to file accurate returns as some details may have been missed by them.

The tax authorities have assured that there will be no problem in filing your return and it is not necessary that your return will be taken for scrutiny as the details in AIS and return do not match. While it can take up to 90 days to recover the information, government officials say that in many cases the data has been corrected within minutes.

A senior official said, “People should take up the issue with the tax department and approach the reporting agency wherever possible, but they should go ahead and file their returns without waiting for the data to be updated. ”

Most taxpayers have found the information in order, but there are instances where the full value of the sale of a property belonging to multiple owners is shown in each owner’s AIS because the data that the property registrar shares does not have that portion. Everyone has it. Similarly, in case of joint accounts, the interest income may have been shown in the AIS of both the account holders. In cases such as property transactions or joint accounts, the same may be reported in the “remarks” section, the tax officials said.

A taxpayer is given five options on viewing the information, the officials explained – she can either accept the data or reject it if the data does not pertain to her and may be wrongly reflected in her tax account. Alternatively, it may be related to someone else’s PAN, or may be related to the previous year or may be related to duplicate or other information.

The officials suggested that the taxpayer can click on the relevant box and enter the details in the comment section. However, officials said discrepancies in the tax system should be flagged as they would be available if your case is probed.