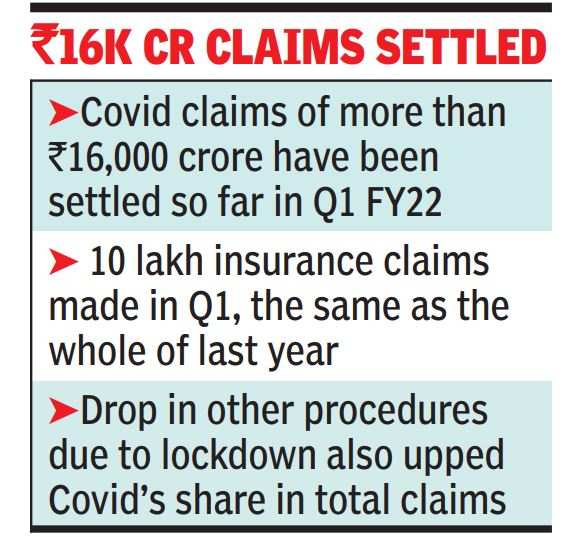

According to industry executives, insurance companies have already settled claims worth over Rs 16,000 crore due to COVID and the number is still rising.

“As an industry, we had 10 lakh claims in the first quarter of this year, which is similar to the number of claims last year. The claims are close to the provisions we made last year.” Ritesh Kumar, MD & CEO, HDFC ERGO General Insurance. He said if his company’s experience is anything to go by, 25% of the claims are yet to come.

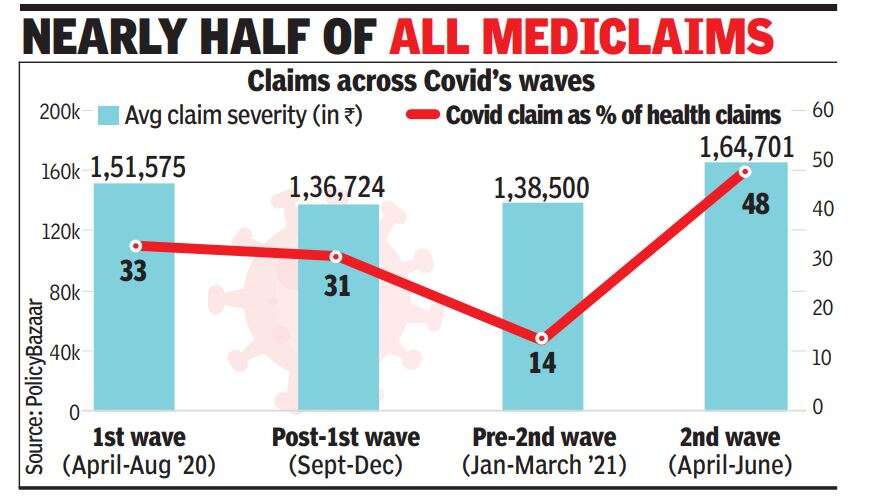

According to Policybazaar India Health Insurance Head Amit ChhabraIn the first wave of the pandemic, COVID treatment claims accounted for a third of the total health claims. It fell to 31% as of the first wave in the December quarter, while the share of private treatment increased. Before the second wave hit, there was a sharp drop in COVID hospitalizations and an increase in elective procedures, resulting in the share of COVID claims falling to 14%.

In the first quarter of the current financial year, Covid claims are expected to exceed 50%. There are still claims of reimbursement for hospitalization and home treatment. Another reason for the rise in COVID claims during the first quarter is the decline in other diseases due to the lockdown. “Accidents are rare. food drops, hence the chances of contracting infectious diseases are also reduced and elective surgeries like cataract and knee replacement are postponed,” Chhabra said.

On the other hand, COVID has given rise to a growing demand for health insurance. The premium collected for health insurance has increased from Rs 51,674 crore in FY15 to Rs 58,572 crore in FY15.

As insurers learn to live with the claims of COVID, they are designing health insurance products with this in mind. A key aspect of COVID is that a major part of hospital bills are from consumables that are not covered under standard health policies. Insurers are now creating policies that cover consumables.

.