Has the market downturn hit enterprise this yr? Are transactions taking place?

Whereas pipelines proceed to be robust, given the valuations available in the market, public capital market transactions stand deferred. You want predictable circumstances to execute transactions. We’re seeing robust exercise in M&A and there are a number of motivations for that. It’s pushed by monetary sponsors taking a look at value-creation transactions. There are consolidation offers the place worth performs are getting created. There are transactions the place shoppers are reviewing their portfolio and seeking to rebalance. At instances it occurs via public markets, they’re now taking place via consolidation.

How a lot does India contribute to JP Morgan’s enterprise?

India is an important marketplace for JP Morgan and we proceed to put money into India and China. For us, these markets supply the best potential and create the most important alternatives simply due to their international linkages. Company India has additionally grow to be more and more worldwide over the previous couple of years. We don’t share numbers for the Indian market individually. As our chairman Jamie Dimon stated, India is a several-hundred-year wager for JP Morgan.

Will the rupee depreciation have a serious impression on enterprise and financial system?

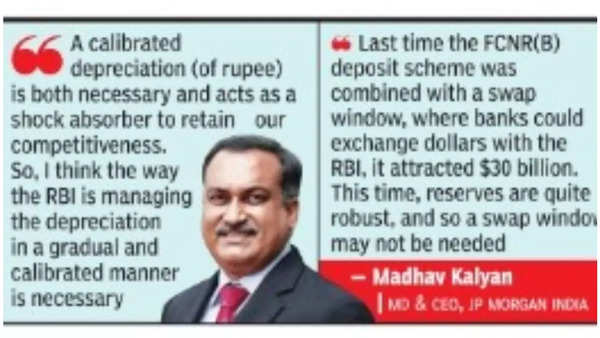

I feel we’re doing all the appropriate issues in an surroundings that’s seeing the greenback strengthen and most rising & developed market currencies depreciate. A calibrated depreciation is each vital and acts as a shock absorber to retain our competitiveness. So, I feel the best way the Reserve Financial institution of India is managing the depreciation in a gradual and calibrated method is important. Should you take a look at the trade-weighted foreign money, that’s largely stayed flat, which implies we proceed to be aggressive. Inflation is one thing that financial coverage must fight, and the method to front-load motion to anchor expectations is the appropriate factor to do. I feel each the approaches — on the foreign money aspect to be calibrated within the depreciation course of and on the rate of interest aspect to front-load motion to cope with inflation — are completely the appropriate methods to method the state of affairs.

An enormous chunk of exterior business borrowings (ECBs) is arising for renewal for corporates. Will this trigger an issue?

Many corporates have sufficient money to cope with the repayments utilizing both the home bond markets or different sources of capital like financial institution finance or syndicated loans. Each company and financial institution steadiness sheets are at their healthiest ranges at this level of time. With corporates having deleveraged, there’s a pure buffer out there. The worldwide bond markets too have opened up for Indian traders. Maturing ECBs will not be one thing that we fear about.

The federal government has rolled again a lot of the windfall good points tax. Will this assist?

It’ll augur properly on a number of fronts. It helps exports and it allows company leverage worldwide costs for companies. After we wish to disinvest stakes in state-owned entities, eradicating restrictions that come of their method of accessing the worldwide markets make it a bit extra enticing.Is there concern of the rising twin deficit placing strain on credit standing?

No worldwide ranking company has even come near suggesting a ranking watch. In addition to, the standard of fiscal deficit in India is completely different. We’re utilizing it for presidency spending and consequently reviving the non-public capex cycle.

India has been working to be a part of international bond indices. However some really feel that the passive funds would possibly turn into scorching cash…

Passive cash doesn’t are usually scorching cash. In case you have a sure weightage in an index, they (passive funds) will proceed to be invested round that. So long as the weightage doesn’t change for any cause inherent to us, these flows are usually extra steady they usually deliver stability to the bond markets. India has over $600 billion that comes into fairness markets. Our bond markets don’t entice greater than $40-50 billion. As soon as index inclusion occurs, it is going to deliver pretty steady flows from traders who’re measured towards the index. A whole lot of the work has been finished and far of the constructing blocks are already in place to make India a part of international bond indices.

The RBI has allowed rupee invoicing and settlement in international commerce. How do you see this?

The power to bill in rupees shouldn’t be new. The most important customers for rupee invoicing are multinational companies that offer to their subsidiaries in India. These MNCs have been doing rupee invoicing to measure the efficiency of their subsidiary with out the aspect of alternate danger. All of the foreign money dangers can then be managed in a centralised treasury. There are international locations that do bilateral commerce with us like in oil and wish to commerce in our foreign money. Third, there has all the time existed an Asian Clearing Union mechanism for SAARC international locations they usually might need to use rupees for the area.

Do you suppose there’s a want for a particular scheme to draw greenback flows?

The US in tackling inflation and making an attempt to cope with the truth that there are detrimental actual charges. The market is pricing in a 75-100 foundation factors (0.75-1 proportion level) improve by the Fed. NRIs can select between the US and India to take a position. Some banks have already elevated FCNR charges by 85bps and it will entice a specific amount of flows. Final time the FCNR(B) deposit scheme was mixed with a swap window, the place banks might alternate {dollars} with the RBI, it resulted in attracting $30 billion. This time round, reserves are fairly strong, and so a swap window is probably not wanted. Additionally, with the ECB ebook arising for renewal, banks can deploy no matter international alternate they elevate.