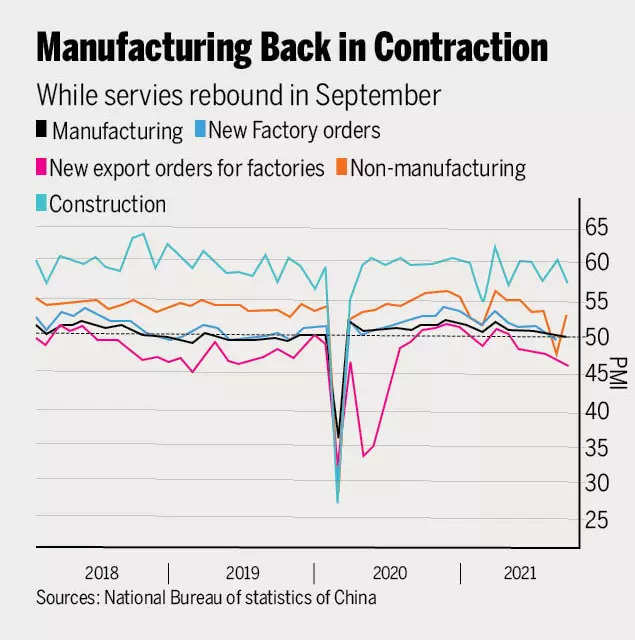

A fall below the 50-point mark in the Official Manufacturing Purchasing Managers’ Index, indicating a decline in output, indicates a broader power crunch on growth.

With tighter measures to rein in the property market, the latest developments have prompted economists to roll back full-year growth predictions below 8% and warn that Beijing prepares to endure a sharp recession. as it tries to improve its economic model.

The problem for the economy is that manufacturing and property investment have been the main drivers of growth since the pandemic hit, while consumption growth remains relatively weak and households are still cautious about traveling and eating out.

Bo Zhuang, China economist at Loomis Salles Investments Asia, said the power outages, which have led to power cuts across China this week, curbing assets “have hit a double whammy on key drivers of growth this year.” “Another growth slowdown is inevitable.”

Beijing focuses on curbing volatility: central bank tells financial institutions to prevent fallout from asset meltdown that exacerbated debt crisis in China Evergrande Group, and prospect of targeted financial easing aimed at manufacturing sector Might be possible.

But economists see little chance of a relaxation of tough policy such as restrictions on housing purchases and energy use limits until December, when President Xi Jinping and top officials meet to set economic priorities.

What Bloomberg Economics Says

Additional policy support will soon be needed to arrest the sharp decline in growth.

The near-term outlook for the economy is highly challenging and uncertain. Headwinds include softening external demand, continued virus risks and a lack of fast, ready-made solutions to energy shortages. Regulatory strictness is also a significant pressure.

When the government set its growth target “above 6%” in March, economists saw it as modest against their predictions of 8%-plus. Many are now reconsidering their views, with major banks ranging from Goldman Sachs Group Inc. to Nomura Holdings Ltd., slashing their forecasts to 7.7% in recent weeks.

Here’s an in-depth look at the challenges facing China’s economy:

power outage

Sugar factories in 21 provinces have been hit by power cuts in recent weeks, largely driven by rising coal prices, making it unprofitable for power plants to sell electricity at fixed prices.

The impact was in the Official Manufacturing Purchasing Managers’ Index, which fell from 50.1 to 49.6 in August, well below the 50 average estimate in a Bloomberg survey of economists.

Beijing has scrambled to solve the problem by allowing power companies to raise prices and try to funnel more coal into the region. Those efforts could get production running in many factories again, but that relief may not come for weeks.

In addition, Beijing is indicating it wants highly energy-intensive producers, such as steel and chemical factories, to reduce production for the rest of the year, as it tries to meet environmental targets.

According to Ming Ming, head of fixed income research at Citi Securities, China’s goal of reducing energy intensity, or how much power is needed to drive production, would push full-year growth from 0.3 to 0.6 to about 3% in 2021. Can drag down to percentage points. Co.

According to Chen Long, a partner at consulting firm Plenum, a rollback of the energy intensity target is unlikely before the end of the year.

“This year’s target is above 6%, so growth isn’t really a concern,” he said, adding that the economy could grow less than 4% in the fourth quarter.

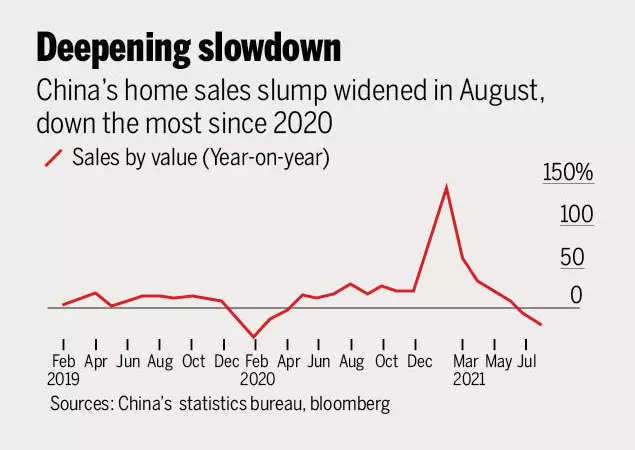

asset downturn

Evergrande is facing a debt crisis that has rocked financial markets and attracted global attention. The company only accounts for about 4% of China’s property sales, so economists are more concerned about a broader slowdown in real estate investment, caused by the government slowing the pace of mortgage lending and curbing financing for property developers. inspired by the efforts of

China’s central bank this week asked financial institutions to cooperate with governments to stabilize the property market, reiterating a call for a “healthy development” of the real estate sector.

This may indicate a “marginal adjustment” of real estate credit policy to ensure that people in need of housing get loans, according to a report Thursday on the official Securities Times social media account.

deepening recession

Beijing wants to avoid a crash in the market, but has vowed not to use the property sector to stimulate growth and is therefore unlikely to move significantly towards easing restrictions.

Real-estate investments could fall 2% to 3% year-over-year in the second half of the year, according to baseline estimates from UBS Group AG.

In a worst-case scenario, asset investment could drop by 10%, according to UBS economists led by Wang Tao, which would reduce China’s economic growth by 1 to 2 percent over the next few months.

weak consumption

China has been tested by coronavirus clusters in the southeastern and northern regions in recent weeks. The country’s zero-tolerance approach to the virus means that stringent restrictions will hamper an already slow recovery in consumption. The slowdown is most visible in China’s car sales, falling nearly 15% year-on-year in August.

Sightseeing Slowdown

The latest outbreaks led to a reduction in tourism revenue in a national holiday period last week. This is likely to be repeated over the seven-day National Day holiday in early October, with Chinese health officials advising the public to avoid unnecessary travel.

commodity prices

Rising prices of coal and other commodities have stymied profit growth for downstream manufacturers in sectors such as electronics and automobiles, which were already dealing with challenges such as record shipping costs and microchip shortages.

Industrial profit growth already fell to its lowest level in nearly a year in August.

Some factories are cutting production, fulfilling only the most profitable orders. Raising electricity prices may be a solution to power cuts, but it will add to their cost burden.

Craig Botham, chief China economist at Pantheon Macroeconomics, said in a report on Wednesday that, although the disruption should be cleared up at some point, “higher energy prices will nonetheless impact activity.”

.