The scenario is grim and is now impacting companies that have been as soon as deemed protected from money crunch, together with Nation Backyard Holdings, China’s largest builder by gross sales.

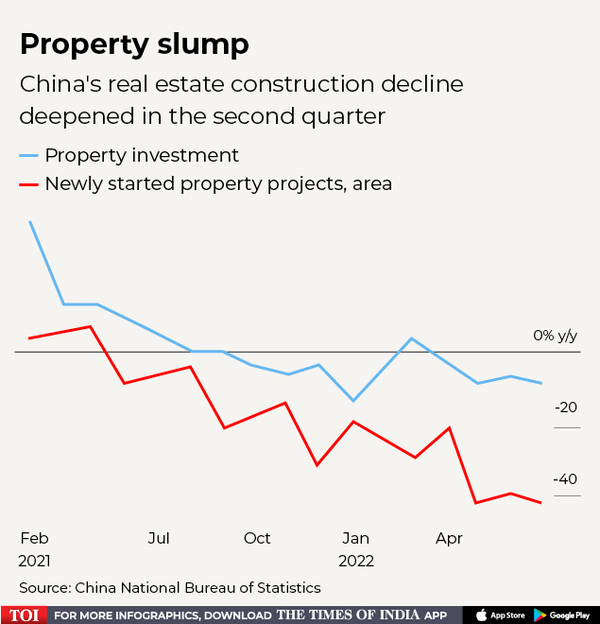

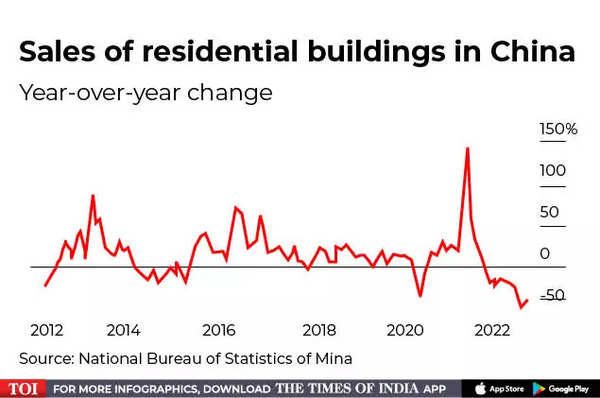

Property gross sales plunged for the tenth straight month in June, underscoring how authorities reduction efforts are failing to curb the disaster.

It’s in reality a giant jolt for cash-starved property builders who’ve for lengthy relied on pre-sales of flats.

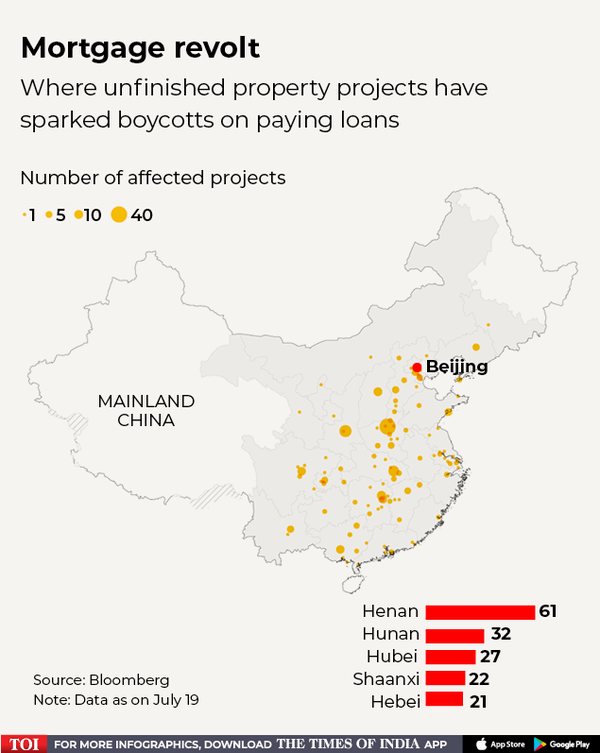

Homebuyers have stopped mortgage funds on not less than 200 tasks in additional than 80 cities in China, and the numbers are rising with every passing day.

It has additionally impacted the banking sector adversely with hefty fall in values. They’re additionally reporting a drastic fall in demand for housing loans by prospects.

The disaster has additional fuelled speculations of antagonistic affect on the financial system and aggravated its actual property disaster.

Other than protests and threats of mortgage boycotts, homebuyers are additionally contemplating taking their enterprise to deep-pocketed state-owned builders, or insisting solely on shopping for accomplished flats.

E-house China Analysis and Growth Establishment estimated stalled actual property tasks throughout China contain 900 billion yuan price of mortgages within the first half, or 1.7% of the whole excellent mortgage loans, in response to a report by Reuters.

Property woes mount

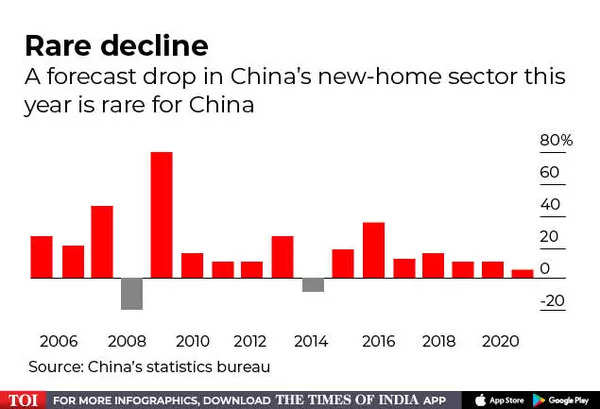

China’s actual property sector has been lurching from one disaster to a different over the previous 12 months, because it grapples with mounting liabilities, a slowing financial system and flagging demand, whereas its sources of recent fundraising have been drying up.

Some massive non-public builders like Evergrande have already defaulted on offshore debt obligations and struggled to boost funds from different sources, together with banks.

A current report by UBS estimated the property disaster in China to worsen, wiping off $1 trillion from the worldwide market.

In different phrases, what began as bother with China Evergrande Group is now snowballing right into a disaster that dangers engulfing nearly all of the nation’s builders, its greatest lenders and a center class that has important wealth tied to the property market.

House gross sales fall

House gross sales tumbled 41.7% in Might from a 12 months earlier, with funding dropping 7.8%.

The actual property business has an outsized affect on the financial system. When associated sectors like development and property providers are included, actual property accounts for greater than 1 / 4 of Chinese language financial output, by some estimates. About 70% of family wealth is saved in property, together with 30-40% of financial institution mortgage books, whereas land gross sales account for 30-40% of native authorities revenues, in response to Pantheon Macroeconomics’ Botham.

The worsening disaster will take a look at authorities’ skill to reduce the fallout. Earlier this 12 months, China was establishing a stability fund to offer assist to distressed monetary companies as dangers to the financial system develop. Dealing with such points will probably be additionally key for President Xi Jinping forward of a management confab broadly anticipated to cement his rule for all times.

The slowdown in development can be hurting demand for constructing supplies. Iron ore slumped greater than 8% on Thursday, falling under $100 a ton for the primary time since December, and dipped additional on Friday.

A 12 months in the past, iron ore was buying and selling comfortably above $200 a ton, with China’s wave of Covid-era stimulus feeding a increase for property and the metal market. Futures for metal rebar in development collapsed in Shanghai to their weakest since 2020. Copper tumbled to a 20-month low.

In actual fact, China’s Covid Zero coverage is exacerbating the scenario by damping demand for property and miserable financial exercise.

E-house estimated stalled actual property tasks throughout China contain 900 billion yuan price of mortgages within the first half, or 1.7% of the whole excellent mortgage loans.

Swap wheat for a home

Based on a report by Enterprise Insider, some builders in China’s depressed property market are accepting wheat, garlic as down cost for properties to offer a lift to their housing gross sales.

As actual property investments within the nation dropped, property developer Central China Actual Property supplied to swap wheat for home as a part of its promotion plan in Minquan County, Henan Province.

The report additional talked about that at 2 Chinese language yuan ($0.30) for each catty, patrons pays as much as 160,000 yuan ($23,900) of their down cost with wheat.

With the target of benefiting the garlic farmers in Qi County, the property developer was accepting garlic as cost on the event of recent garlic season within the nation.

“We’re serving to farmers with love, and making it simpler for them to purchase houses,” it added.

Different property builders in japanese cities of Nanjing and Wuxi have been additionally accepting watermelons and peaches from farmers, the Enterprise Insider report mentioned.

What authorities are doing

China’s banking regulator repeatedly sought to reassure homebuyers and monetary markets over the previous week that pre-sold houses could be correctly delivered, whereas encouraging lenders to offer funds as wanted to worthy actual property tasks.

Banks are additionally speeding to reassure traders that dangers from loans to homebuyers have been controllable, with not less than 10 companies issuing statements.

State-owned Agricultural Financial institution of China mentioned it held 660 million yuan of overdue loans on unfinished houses, whereas smaller rival Industrial Financial institution Co. mentioned 1.6 billion yuan of mortgages have been impacted, of which 384 million yuan have turn out to be delinquent.

Regulators have additionally stepped up efforts to encourage lenders to increase loans to certified actual property tasks.

Based on a report by Reuters, the China Banking and Insurance coverage Regulatory Fee (CBIRC) informed the official business newspaper on Sunday that banks ought to meet builders’ financing wants the place affordable.

The CBIRC expressed confidence that with concerted efforts, “all of the difficulties and issues will probably be correctly solved,” the China Banking and Insurance coverage Information reported.

Additional, authorities might also enable owners to briefly halt mortgage funds on stalled property tasks with out incurring penalties, Bloomberg reported citing sources.

The report added that home-owner eligibility and the size of grace durations could be determined by native governments and banks, and the yet-to-be-finalised proposal from monetary regulators would require approval from senior Chinese language leaders.

(With inputs from businesses)

Watch Chinese language actual property sector in turmoil: Why homebuyers are refusing to repay financial institution loans