The amount raised in the IPO this year has reached $8.8 billion, already exceeding the totals of the previous three years, although it is only August.

At the current pace, 2021 will surpass the all-time record of $11.8 billion. Founders, bankers, lawyers and consultants are rushing to capitalize on strong demand for fresh public offerings.

The catalyst, in a word, is Zomato Limited The food-delivery startup went public in July and, despite deep losses and average profit potential, shares have risen more than 70%. This has fueled the idea that similarly profit-challenged startups could get a strong reception from investors.

According to people familiar with the matter, long-time troublemaker OYO Hotels and Homes Pvt started work on its draft prospectus last week and aims to file in October. Ride-hailing leader Ola and fintech startup Pine Labs Pvt have also started talks with investment bankers, according to others aware of the situation.

“India is definitely the star of the show – this is the new phenomenon,” said Uday Furtado, co-head of Asia Equity Capital Markets at Citigroup Inc, the leading foreign bank in the Asia IPO league table so far this year. Opened people’s eyes to India and now we have all these privately funded unicorns coming in the public market.

The performance of recent IPOs like Zomato has added to the excitement. Newly listed Indian stocks are outperforming the benchmark Nifty 50 index by over 40 percentage points this year, the biggest gap in seven years.

The three most valuable startups in the country are all contemplating or planning an IPO. Paytm, the country’s leader in digital payments, has filed its initial offering documents, aiming to raise Rs 16,600 crore ($2.2 billion). If it reaches that level, the IPO will be the country’s biggest ever debut, raising over Rs 15,000 crore by state-owned Coal India Ltd.

According to a Bloomberg News report, Walmart Inc-controlled e-commerce giant Flipkart is targeting an IPO in the fourth quarter.

Byju’s, a digital education startup valued at $16.5 billion, is in early discussions about an IPO and bankers are encouraging the company to take advantage of the red-hot market, according to people familiar with the matter. Byju’s is in the midst of absorbing several significant acquisitions and is likely to hold off on any listing for at least a year.

Such is the frenzy that PhonePe, a payments startup Walmart acquired as part of its Flipkart deal, is considering shifting its incorporation from Singapore back to India, in this case, to attract the attention of local investors. According to two people familiar with who did not want to be identified. .

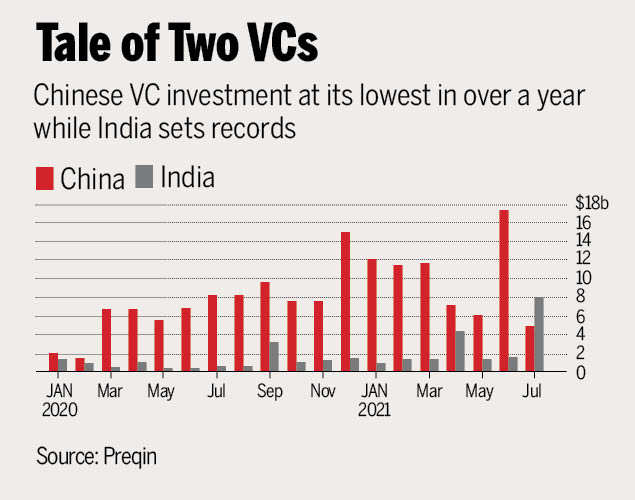

Regulatory turmoil in China has sent investors looking for promising opportunities in countries with more predictable government policies.

Pankaj Naik, Executive Director and Co-Head, Digital and Technology, Avendus Capital Pvt Ltd, said, “If global investors are to choose an emerging market, the balance in China’s internet ecosystem following regulatory action will favor India. Leaning down.” “India may not be as attractive as China in the macroeconomic sense, but it looks like a safe bet.”

Oyo Hotels, PhonePe and Pine Labs did not respond to emails seeking comment.

India’s success with startups lags far behind that of the US or China. But there have been some breakouts this year. With the COVID-19 pandemic, many consumers have turned to online services for grocery delivery and other e-commerce with math tutoring and medical diagnostics. There has been a jump in revenue.

Global investors such as Fidelity Investments, KKR & Co and Singapore’s Temasek Holdings Pte. have pumped money into India, while China’s crackdown on private ventures has scared financiers.

The value of venture investment in India reached $7.9 billion in July, surpassing China on a monthly basis for the first time since 2013, according to researcher Prekin Ltd.

Such financing has helped make India a substantial blessing of unicorns, startups worth $1 billion or more. According to CB Insights, there are over 35 such companies led by Byju’s, Paytm and Oyo, which suggest that dozens more could go public in the coming years.

Whereas in the past there were largest IPO conglomerates or state-backed companies like Coal India, startups are now leading the boom.

Goldman Sachs Group Inc. in Mumbai. “Many of India’s technology unicorns have huge growth opportunities ahead,” said Devarajan Nambakam, Managing Director of India. “Everything is relative and given the huge opportunity, India’s macro fundamentals, political stability and holistic investment policies make it one of the better destinations for global investors.”

People said investment banks such as Goldman, Morgan Stanley, JPMorgan Chase & Co and Citigroup Inc are at the forefront of many discussions. People said the investment banking team of Mumbai-headquartered Kotak Mahindra Bank is also part of several IPO talks.

Oyo, a SoftBank Group Corp-backed startup with a history of troubles, is one of the more surprising IPO candidates. The hotel-booking company, run by 27-year-old Ritesh Agarwal, expanded global with highly aggressive goals and was then hit by the Covid-19 pandemic.

Last year, it cut its workforce, fired thousands and backtracked, as well as cut compensation and marketing.

But the brutal overhaul has let Oyo survive as people stopped traveling and now bookings are recovering in Europe, the US and parts of Asia. Agarwal said in an interview with Bloomberg TV that the coronavirus pandemic hit Oyo “like a cyclone”, with business falling 66% in 30 days.

But the company made difficult changes to focus on the most valuable technology and services for its hotel partners. The startup recently secured $660 million in debt financing from global investors to service its existing debts.

Work on Oyo’s draft prospectus began this week with the goal of filing it with regulators within the next 10 weeks, a person familiar with the developments said. Two banks, Kotak and JP Morgan, have already been selected and Citi is close to joining a lineup that is likely to grow. Many said the timing, size and mix of primary and secondary shares are yet to be decided.

Agarwal declined to comment specifically on the IPO plans in his interview.

“We’re already operating like a public company, when we go public depends on the board,” he said.

If Agarwal tests the public markets, he will have a lot of company. Beauty retailer Nykaa filed its initial offering documents for one share later this month.

API Holdings, owner of the country’s largest online pharmacy PharmEasy, is targeting an IPO of more than $1 billion, with plans to file preliminary documents by mid-October, according to people familiar with the matter.

Pine Labs, a fintech startup that operates in India and parts of Southeast Asia, is being wooed by bankers who claim it can reach a valuation of $10 billion, according to a person in the discussion. with the knowledge of. According to CB Insights, its final value was $3 billion.

“Indian public market investors have shown that they truly value the role of disruption and growth,” said Vani Kola, founder and managing director of venture firm Kalaari Capital. “We will see hundreds of such IPOs in the next decade.”

.