Whereas SBI was the primary to be requested to cease such lending, a supply on the nation’s high lender stated that it prolonged loans to Andhra Pradesh authorities primarily based on a letter from the state authorities, which advised that the required approvals had been in place. As reported by TOI on Thursday, Andhra is the largest person of the software.

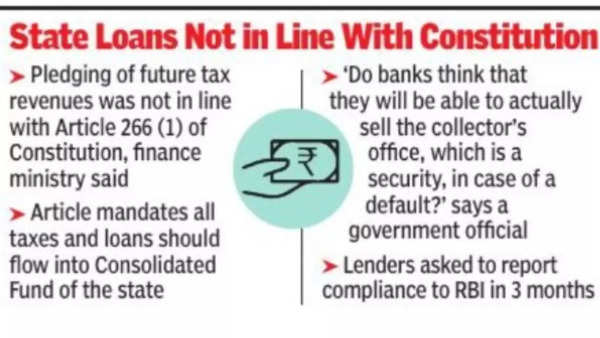

Final yr, in a communication to state, the Union finance ministry had acknowledged that pledging of future tax revenues was not consistent with Article 266 (1) of the Structure, which mandates that each one taxes and loans ought to circulation into the Consolidated Fund of the state. The letter adopted a reference to the Centre that the state authorities had transferred belongings to the AP State Improvement Company (APSDC) to boost funds. Final yr, India Rankings had famous that its rankings to the entity had been primarily based on “unrestricted pledged income” on further retail excise tax (ARET) levied by the Andhra authorities. The cash flowing from 10 depots had been escrowed for assembly the debt servicing obligations on this case.

In 2020, the state authorities had enacted a particular legislation to offer statutory standing to APSDC for project of the recognized ARET income to undertake particular social and developmental exercise. A few of the provisions of the legislation have additionally been questioned by the finance ministry. Final yr, it had identified that these provisions might not be consistent with Article 293 (3) of the Structure, which mandates that states can not borrow with out the Centre’s permission.

In response to India Rankings, eight banks have sanctioned loans to APSDC. Authorities officers stated many of the banks had been state-run, though the names couldn’t be confirmed. “Banks have been clearly instructed to finish this apply. Do banks assume that they’ll have the ability to really promote the collector’s workplace, which is a safety, in case of a default?” stated a high-ranking officer on the Centre.

Confronted with different states, together with Uttar Pradesh, Punjab, MP and HP resorting to related means, the RBI final month was compelled to hunt a overview of such lending practices by the financial institution boards and report compliance by September.

Whereas the finance ministry flagged its concern in final July and SBI stopped disbursements in August, a number of the different lenders disbursed loans as much as November. Officers stated lenders had been violating RBI norms as there’s a grasp round going again to 2015.