New Delhi: The additional interest amount or late fee paid by any taxpayer while filing Income Tax Return (ITR) for the financial year 2020-21 will be refunded. tax department said on Wednesday.

The deadline for filing income tax for FY21 was extended from July 31 to September 30 by the government in view of the challenges faced by taxpayers due to the COVID-19 pandemic.

However, many taxpayers were charged late fees as well. wrong interest When he submitted his ITR after the earlier deadline of 31st July.

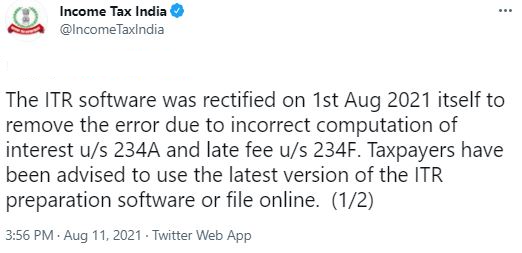

The tax department said in a tweet that the software error was rectified on August 1 itself and urged taxpayers to use the latest version of the software.

The deadline for filing income tax for FY21 was extended from July 31 to September 30 by the government in view of the challenges faced by taxpayers due to the COVID-19 pandemic.

However, many taxpayers were charged late fees as well. wrong interest When he submitted his ITR after the earlier deadline of 31st July.

The tax department said in a tweet that the software error was rectified on August 1 itself and urged taxpayers to use the latest version of the software.

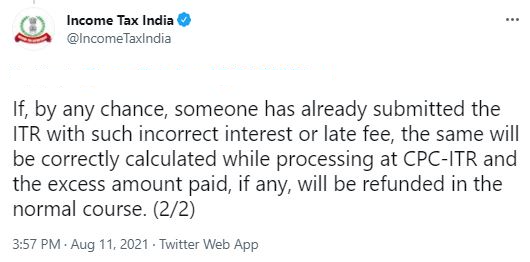

It further assured that if anyone has submitted ITR with wrong interest and late fee amount, the excess amount will be returned to them after careful calculation.

The new income tax e-filing portal www.incometax.gov.in had a bang from the day of its launch on June 7 as it was facing technical glitches.

The tax department has taken corrective measures through Infosys Based on feedback from taxpayers, tax professionals and representatives of the Institute of Chartered Accountants of India (ICAI).

Some of the key functionalities like User Profile, ITR 1, 2 & 4 filing, e-Proceeding, View old ITR are available to the users on the new one. income tax portal, the government informed.

(with inputs from agencies)

.