New Delhi28 minutes ago

- copy link

The monetary policy meeting of the Reserve Bank of India (RBI) will end today, i.e. on 6 April. According to experts, RBI Governor Shaktikanta Das can announce an increase of 0.25% in the repo rate. Currently the repo rate is 6.50%. If this happens then taking a loan will become more expensive.

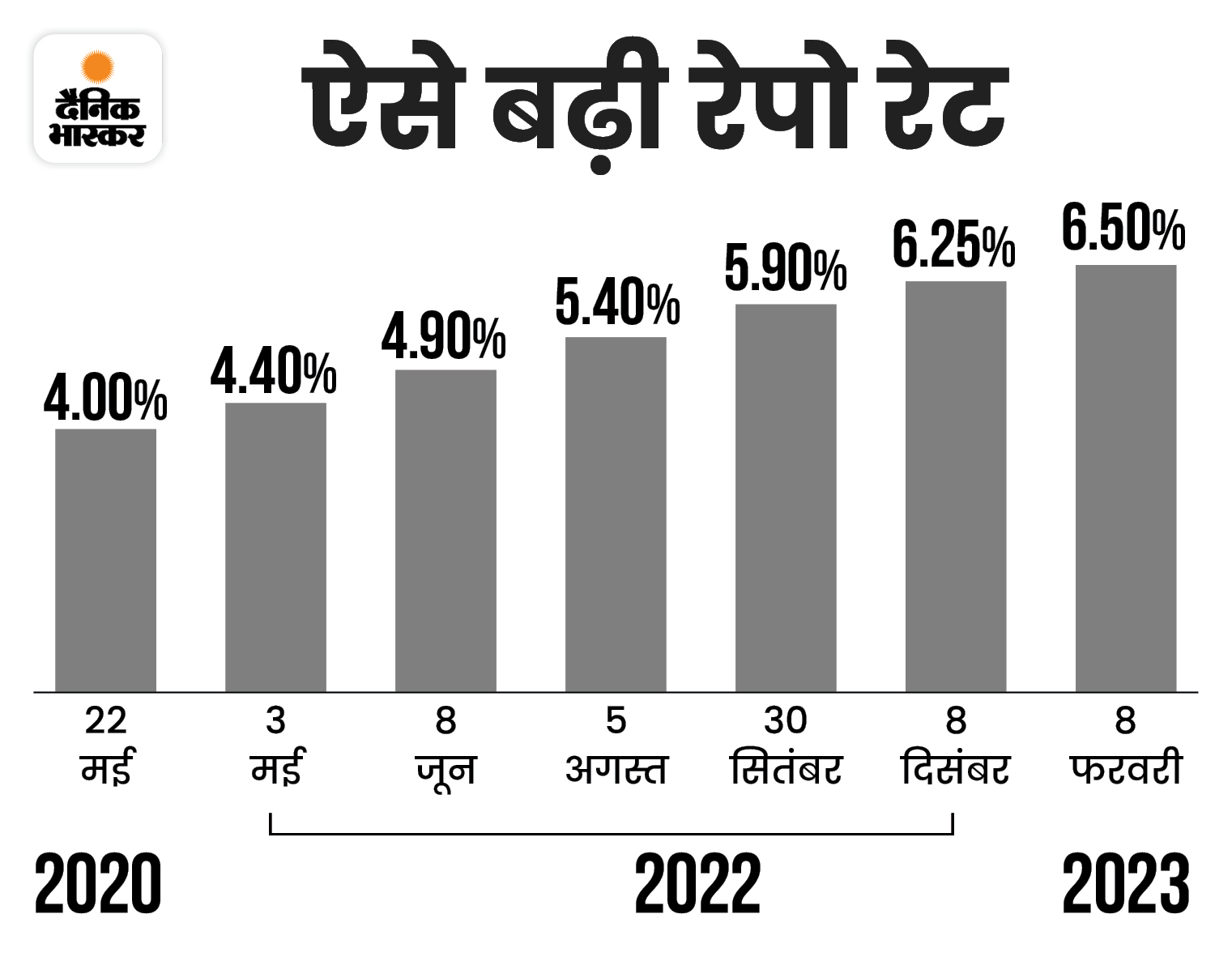

Repo rate increased by 2.50% in 6 times in the last financial year

Monetary policy meets every two months. The first meeting of the last financial year 2022-23 was held in April-2022. Then the RBI had kept the repo rate constant at 4%, but on May 2 and 3, the RBI called an emergency meeting and increased the repo rate by 0.40% to 4.40%.

This change in the repo rate took place after 22 May 2020. After this, in the meeting held on 6 to 8 June, the repo rate was increased by 0.50%. This increased the repo rate from 4.40% to 4.90%. Then in August it was increased by 0.50%, taking it to 5.40%.

Interest rates went up to 5.90% in September. Then in December the interest rates reached 6.25%. After this, the last monetary policy meeting for the financial year 2022-23 was held in February, in which interest rates were increased from 6.25% to 6.50%.

What is repo and reverse repo rate?

Repo rate is the rate at which RBI lends to banks. Banks give loans to customers with this loan. A lower repo rate means that many types of loans from the bank will become cheaper, while the reverse repo rate is just the opposite of the repo rate.

Reverse rate is the rate at which RBI gets interest on deposits from banks. Liquidity in the markets is controlled through the reverse repo rate. A stable repo rate means that the loan rates from banks will also remain stable.

Loan becomes costlier due to increase in repo rate

When RBI lowers the repo rate, banks also lower interest rates most of the time. That is, the interest rates of the loan given to the customers are low, as well as the EMI also decreases. Similarly, when the repo rate increases, the loan becomes costlier for the customer due to the increase in interest rates. This is because commercial banks get money from RBI at higher rates, which compels them to raise rates.