The S&P BSE Sensex index has fallen over 15% from its October highs, drawing close to a 20% loss reflecting a bear market. The sell-off comes as rising costs and a record depreciation in the rupee have forced the country’s central bank to join forces with global peers in raising interest rates.

The value of the Indian stock market is down about 20% from its January peak at around $3.7 trillion. Unprecedented exodus of foreign investors and the shaky economic backdrop, combined with earnings projections, appear set to cloud the outlook for a rebound.

“We expect the markets to correct further from here,” said Benifer Malandkar, Chief Investment Officer, Rai Global Investments Pvt Ltd. “Hopefully by the second quarter, the most negative news, the outcome of the Fed’s actions, will pay off.”

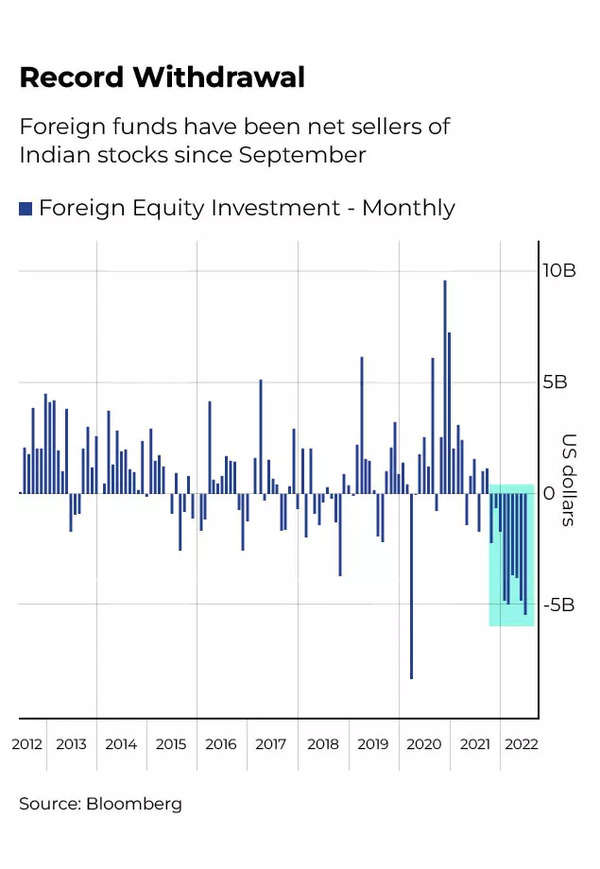

foreign flight

Foreign investors have been selling Indian shares at a record pace since September, pulling out around $32 billion from the market. The retreat of foreigners is also part of the wave-hit countries, including South Korea and Taiwan.

“India is not isolated as it is part of an emerging market, and clearly EMs are out of favor,” said Ray Global’s Malandkar. “As long as the US Fed rate is at its peak, we will see a redemption taking place in the EM.”

pink guess

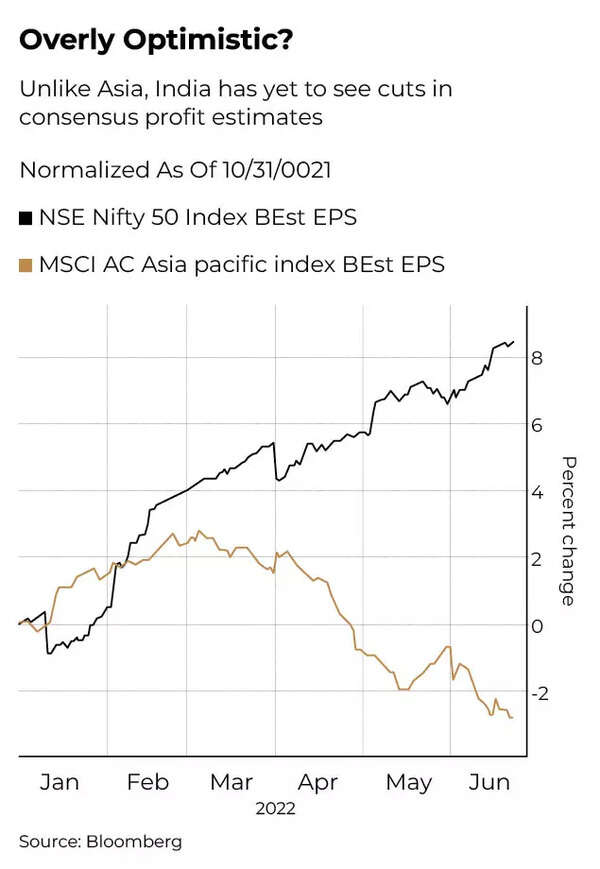

decline in Indian Equity The valuations so far have mainly been on account of contraction. Earnings forecast for the NSE Nifty 50 index is yet to show a meaningful decline, as seen in MSCI Inc’s broader measure for Asian equities.

Over the past few weeks, strategists at Sanford C. Bernstein Ltd., Bank of America Corp and JPMorgan Chase & Co have expressed concern about earnings optimism that surrounds India. Pending any rebound in valuations, the cut in estimates is likely to further pull down the shares.

suffering from small-cap

Gauges of small and mid-cap Indian stocks have already entered bear markets, with smaller stocks being impacted more by investors’ risk appetite. Markets have weakened, with just 16% of the S&P BSE 500 index stocks trading above their 200-day average, their lowest level in two years.