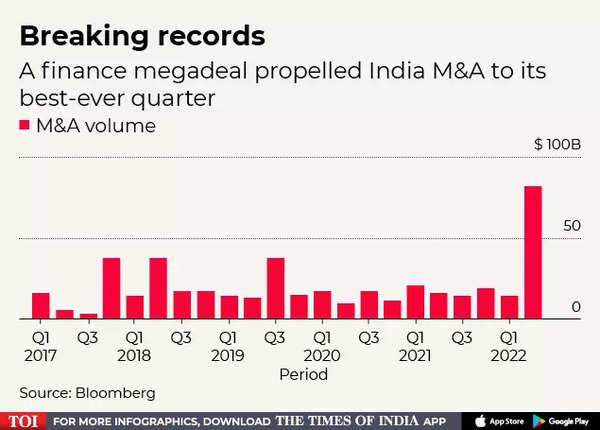

According to data compiled by Bloomberg, India completed $82.3 billion in pending and M&A deals in the second quarter, the highest amount on record. This is more than double the previous record of $38.1 billion in the third quarter of 2019. Globally, M&A volumes in the quarter declined 8.7% from the same period in 2021 to reach $827.6 billion.

The boom in India was dominated in April by HDFC Bank Ltd’s $60 billion all-stock purchase of Housing Development Finance Corp., India’s most valuable bank and the country’s largest mortgage lender in the largest M&A transaction. The move shows that India’s major companies, facing the rise of fintech and disruptive trends such as climate change, are turning to dealmaking as a strategy to transform themselves dramatically.

According to Sonjoy Chatterjee, President and CEO of Goldman Sachs Group Inc., “While the Group will consolidate to become stronger and gain market share in its core segments, there will be renewed or renewed initiatives around two big themes: ESG and digital. Will go.” in India. He added that the second one is particularly the focus for all companies, no matter what the sector.

“There will be no strategy going forward that does not provide a clear path to accomplish this,” Chatterjee said.

Mindtree Ltd. and Larsen & Toubro Infotech Ltd., a combination of two software firms controlled by engineering conglomerate Larsen & Toubro Ltd., in a $3.3 billion all-stock deal announced in May, further explained how India’s largest firms find themselves in a changed position. But keeping. Scenario in technology, aided by volatility in markets.

Even without the HDFC megadeal, India’s second quarter would still rank as its fifth best quarter on record, thanks to billionaire Gautam Adani’s $10.5 billion deal to buy Ambuja Cements Ltd., giving his conglomerate the industry. got a big presence.

Ganesan Murugaiyan, Head of Corporate Coverage and Advisory at BNP Paribas SA in India, said, “With the market recovery in India, the appetite of strategic investors has definitely increased.

The companies leading the transition to renewable energy in India were among the biggest traders. Shell plc agreed to buy renewable energy supplier Spring Energy Pvt in April for $1.5 billion, while French oil giant Total Energies SE this month bought a 25% stake in Adani New Industries Ltd. The firm plans to invest more than $50 billion in technologies such as green hydrogen over the next decade.

Murugaiyan said it would be challenging to put together a large acquisition. “It’s not that easy to get long-term financing and the high-yield leverage buyout market — corporate debt — has literally taken off.”

Like Chatterjee, Murugaiyan sees the green and digital transition driving more transactions. His team has grown from nine bankers in 2021 to 12 this year, and he is looking to add another three.

The next wave of deals could come in the middle market, where a group of aging founders are starting to pass the reins on to their offspring.

“Regularly, we find that there is interest in the next generation of other disciplines, particularly technology platforms and ESGs,” Chatterjee said. “The themes coming out of the pandemic have modified attitudes and choices about what the next generation wants to do with their future – in a very personal way.”