How much will your EMI increase after today’s policy of RBI

RBI Rate Hike News: The Reserve Bank of India (RBI) on Wednesday raised the repo rate by 50 basis points to 4.90 per cent to strengthen the fight against inflation. The decision paves the way for an increase in the interest rate on all types of loans for banks, housing finance companies and lending institutions. When banks and lending institutions increase the interest rates accordingly, eventually existing and new borrowers will have to pay higher EMIs for their loans.

Today’s hike comes within 36 days of the final repo rate hike of 40 bps at an off-cycle meeting of the six-member rate setting panel, which marked a change in the RBI’s track by focusing on prioritizing inflation over growth. . In his address today, the RBI governor said the war in Ukraine has led to globalization of inflation and “our steps will be calibrated, focused on bringing inflation down to the target level”.

With the latest hike, the benchmark lending rate has now touched a two-year high of 4.90 per cent. Banks and lending institutions have already increased interest rates on all types of loans after the RBI hiked the repo rate on May 4. Money is sure to increase.

Manoj Dalmiya, founder and director, Profitable Equities, said retail customers will face a direct impact as the cost of lending for banks will increase.

Suren Goyal, Partner, RPS Group, said, “The hike in rates leaves banks with no option but to pass on the burden to the customers.

Let us understand how the rate hike will affect your EMI.

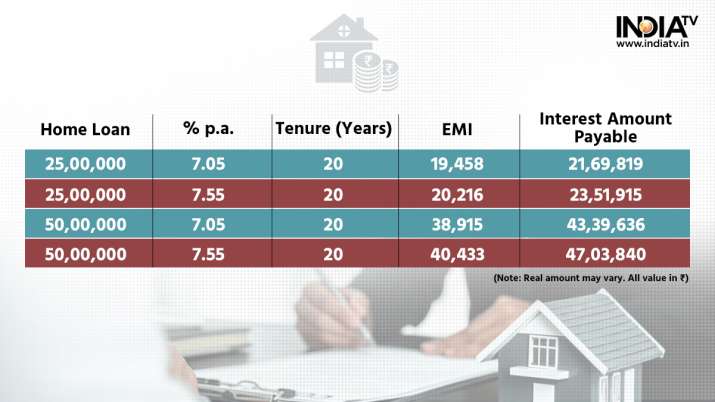

home loan

If you have taken a home loan of Rs 25 lakh at 7.05% p.a. for a tenure of 20 years and increased the interest to 7.55%, your EMI will increase by approximately Rs 758 from Rs 19,458 to Rs 20,216. The total interest amount payable will be Rs 23,51,918 as against Rs 21,69,819. The EMI of Rs 50 lakh will increase by Rs 1,518 from Rs 38,915 to Rs 40,433 and the total interest payable will be Rs 47,03,840.

Home loan EMI will increase after today’s rate hike

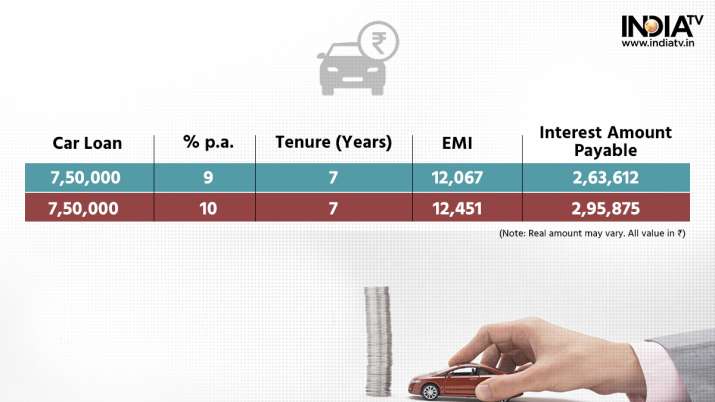

car and bike loan

Similarly, if the interest rate on an auto loan of Rs 7.50 lakh with a tenure of 7 years is increased from 9% to 10%, the EMI will become costlier by Rs 400.

Car loan EMI will increase after today’s rate hike

Bike loan EMI will increase after today’s rate hike

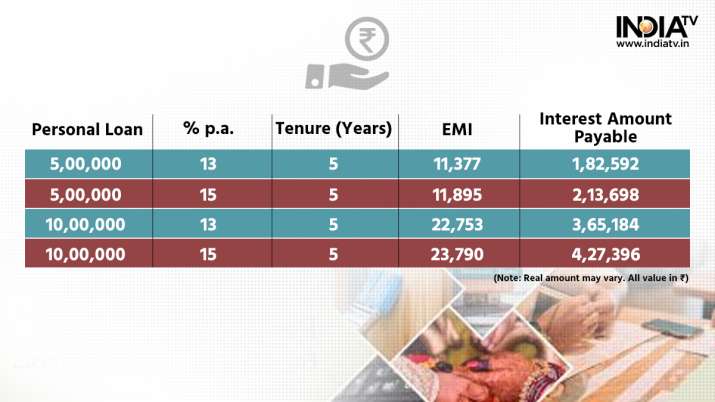

personal loan

Similarly, for a person taking a personal loan of Rs 5 lakh at the rate of 13% p.a. for a tenure of 5 years, the EMI, if the interest rate rises to 15%, will increase from Rs 518 to Rs 11,377 to Rs 518 Will go 11,895 Rs.

Personal loan EMI will increase after today’s rate hike

what next?

To curb inflation, regulatory bodies are required to control the liquidity circulation in the economy. For a few months, the inflation rate has been above 6% which is beyond RBI’s comfort zone. If not controlled, inflationary pressures can destabilize growth. Two quick hikes show that the central bank is concerned about rising prices. The government has also resorted to unconventional methods of curbing inflation by cutting taxes on fuel and limiting exports. But there is no sign of inflation coming down yet.

“Given the current inflation dynamics in India and globally, the RBI is set to continue raising potentially higher in August and October MPC meetings, before shifting to a lower gear for the bulk of H2 FY23. There is potential. The central bank clearly remains focused on long-term price and financial stability and stability of growth,” said Siddhartha Sanyal, chief economist and head of research, Bandhan Bank.

The government has tasked the central bank to ensure that retail inflation remains at 4 per cent with a margin of 2 per cent on either side.

Read more: How will the rate hike by RBI reduce inflation? Explained