The new framework provides for a market-determined exchange rate between two trading partners. “Ever since sanctions were imposed on Russia, the payment problems with the country have almost come to a standstill. As a result of the trade-facilitation mechanism introduced by the RBI, we see that the payment problems with Russia are easing. This move will also reduce the risk of foreign exchange volatility, especially given the Euro-rupee parity. We see this as the first step towards 100% convertibility of the rupee,” said Engineering Exports. Mahesh Desai, President of the Promotion Council said.

Exporters are waiting for a payment mechanism with Russia to start shipping goods that do not face sanctions, including pharma and food products. If a business partner agrees to billing in rupees, they will either receive or pay into a special Rupee Vostro account, which Indian banks have been allowed to open on behalf of foreign partners. A Vostro account is opened by a bank in its home country on behalf of a foreign bank. Money in Rupee account can be used by the export partner for doing business with any person accepting Rupee.

According to Federation of Indian Export Organization president A Sakthivel, under the existing foreign exchange laws, the final settlement should be in free foreign exchange, except in Nepal and Bhutan. “Now the final settlement for all countries, if approved by the RBI, can be in Indian rupees,” he said.

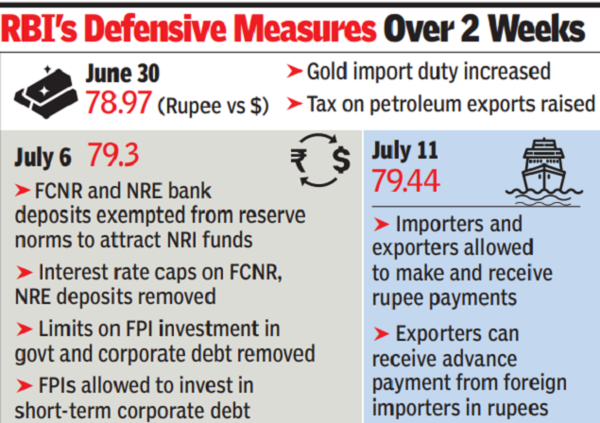

He said that this step has been taken on time as many countries are facing acute shortage of foreign exchange in Africa and South America. Also, the government will need to clarify on the availability of incentives currently available for foreign exchange earners. Bankers said the rupee invoicing would reduce forex exposure. Dollar became extremely volatile and many currencies hit new lows against the dollar.

Talking to TOI, a banker said that this is a big step that internationalization Why currency?

“Nothing is going to change overnight. If you look at the internationalization of Chinese currency, it happened over time and many measures were taken,” he said. He expected more measures to boost rupee trade and move international financial markets to GIFT City. Getting the key to the business partners to accept Rs.

Before implementing this mechanism, banks will have to take permission from RBI. “In order to promote the growth of global trade with emphasis on exports from India and to support the growing interest of the global trading community in the Indian Rupee, it has been decided to introduce an additional mechanism for invoicing, payment and settlement of exports.” The import has been done in Rs.