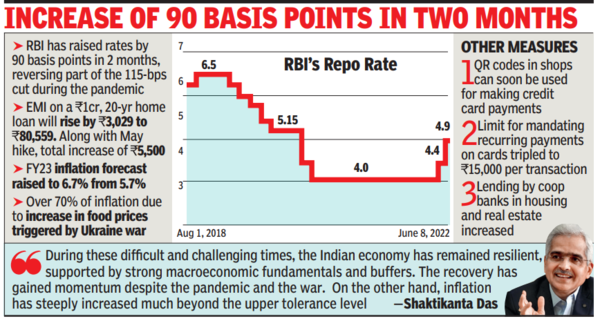

RBI’s action will automatically increase the cost of mortgage as more than 90% of banks are linked to home loan repo rate. With this increase, EMI At Rs 1 crore, a 20-year home loan will increase by Rs 3,029 to Rs 80,559 from Rs 77,530. With the May 4 hike, consumers are seeing an increase of 90 basis points in 35 days, taking the total on such loans to Rs 5,500 per month.

While deposit rates will also rise, growth is expected to slow as the banking system is still laden with pandemic stimulus, though surplus cash has declined from Rs 7.4 lakh crore in April to Rs 5.5 lakh crore in May 2022.

The bad news for borrowers is that this is not the last rate hike by the RBI. Crisil expects the RBI to hike by another 75 basis points this financial year – a view echoed by most economists. This would mean that by the end of March, interest rates would be half a percentage point above pre-pandemic levels.

Elaborating on the rate hike, Das said the RBI now expects inflation to be 6.7% in 2021-22, as against 5.7% in the April policy. Das said that 70% of inflation was due to food prices, which have risen globally after the conflict in Ukraine. Also, the average price at which India imports crude oil is now expected to be $105 against $100 earlier. Das said the current conflict is becoming a hindrance to global trade and development.

The positive news is that the recovery in the health of the economy has encouraged the RBI to deliver stronger medicine to deal with prices, which is gaining traction after a two-year pandemic. Das said the capacity utilization in the industry has increased from 72.2% in Q3 of FY12 to 74.5% in Q4 of FY12 and is expected to increase further due to better corporate balance sheet. At the same time, the services sector and rural economy are also expected to pick up on the back of a normal monsoon.

“During these difficult and challenging times, the Indian economy remains resilient, supported by strong macroeconomic fundamentals and buffers. Despite the pandemic and the war, the recovery has accelerated. On the other hand, inflation has risen much above the upper tolerance level,” Das said.

The banking industry reported its highest ever profit in FY22 after cleaning up balance sheets, and corporates reducing debt, meaning the ‘twins’ that plagued the Indian economy before the pandemic The ‘balance sheet problem’ is over now.

Das, however, retained the GDP growth forecast at 7.2 per cent. The deviation from earlier policies was the lack of assurance that the RBI would remain lenient. the governor said MPC Voted unanimously to withdraw housing to ensure inflation remains within target. Optimism about growth has come from expectations of a normal monsoon and improvement in manufacturing and services. “A rebound in contact-intensive services is likely to drive urban consumption forward. Investment activity is expected to be supported by improving capacity utilization, boosting government’s capital expenditure and strengthening bank credit,” Das said.

While the repo rate serves as the ceiling for money market rates, the floor is determined by the SDF, or permanent deposit facility, which has been increased by 50 basis points to 4.65%. The marginal standing facility used to provide emergency funds to banks is now available at 5.15%.