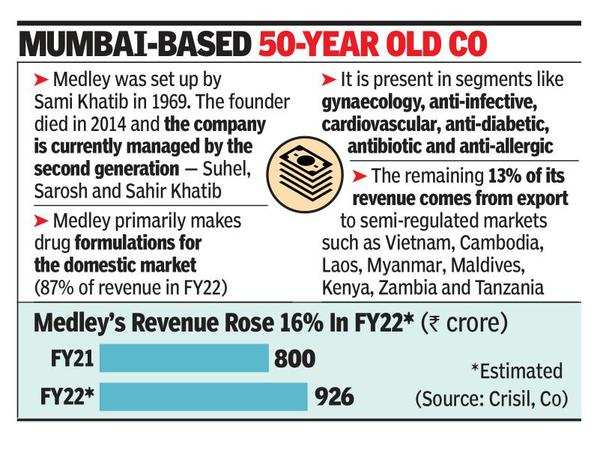

a medium sized player, mix Pharma – Founded by Samik Khatibo According to the healthcare market research firm IQVIA, ‘Medley Laboratories’ – one of the top 40 pharmaceutical companies in India in 1969. Khatib’s second generation – Suhail, Sarosh and Sahir – now manage the company.

It has manufacturing plants in the domestic formulations market, primarily in the haematinic, anti-diarrhoeal, cardiovascular, anti-diabetes, analgesic and anti-ulcer segments. Gastroenterology, anti-diabetic and gynecological drugs together with top brands such as Telmed, RB Tone, Vogli, O2 and Dompan account for two-thirds of the revenue. Some of the first brands launched in India include Dompan (domperidone and pantoprazole), O2 (ornidazole and ofloxacin), Tazocef (tazobactam and ceftriaxone) and Ostium K2 (first brand of vitamin K27 combination in India).

According to a recent report by credit rating agency CRISIL, the company’s revenue is projected to grow 16% to Rs 926 crore for FY22 as against Rs 800 crore in the previous year, driven by the sharp segment (approximately 53). Contribution is supported. % of total sales and the rest from old medicine. It expects to sustain growth of over 8-10% in the medium term, driven by its established position in the domestic formulations market and focus on the older segment (which now accounts for 47% of sales as against 30%). is focusing. a few years ago).

As per market research data, two of its products, RB Tone and O2 (for the treatment of hematinic deficiency and diarrhoea, respectively) feature in the top 300 brands. In FY22, around 53% of revenue came from acute treatments, and the rest came from the chronic segment. The company’s product profile is moderately diverse, with the top five brands accounting for 57% of revenue.

Sources said the promoters are looking at a strategic sale including all the assets, with Cipla probably at the fore. The company did not comment till the time of going to press.

Medley’s operating margin improved to 21% in FY22 and should be maintained at 19-21% levels, aided by improvements in scale and better fixed cost absorption. In addition, the focus is on increasing supply in regulated markets, leading to higher realizations. Due to logistical challenges and sales closure in some African countries like Uganda and Sudan, where some of the earlier payments are still stuck, the share of exports declined to 13% of revenue in FY22 from 15-18% earlier was.

The company will continue to export to the UK and Europe and will focus on increasing contributions from these markets. It has also started supplies to the US from FY 2022. Although there is a subsidiary in Russia, the scale of business is negligible (revenue of 2-4 crores).

Armed with a meager loan of Rs 200,000 under Maharashtra State Finance Corporation’s Technician-Entrepreneur Scheme, Sami Khatib managed to gain a foothold in a tough industry. The company’s first formulation plant was established in 1976 at Aurangabad for tablets, capsules and liquid oral, followed by units at Daman and Jammu. The company exports to 26 countries in Southeast Asia, Africa, the Middle East, Russia and the CIS.