The LIC IPO will open for public subscription on Wednesday and will close on May 9. The anchor portion opens to institutional investors ahead of the retail IPO and anchor investors have to commit to holding on to the shares. According to market sources, the Rs 21,000 crore IPO, which is the largest in the country, would get fully subscribed given the large number of policyholders that the corporation has. The policyholders are being offered shares at a discount of Rs 60. However, many retail investors are wary as several large IPOs have failed to retain their momentum after listing because of their size. According to analysts, the scope for appreciation of the corporation’s shares would depend on how surplus is distributed between policyholders and shareholders and the type of products LIC will sell.

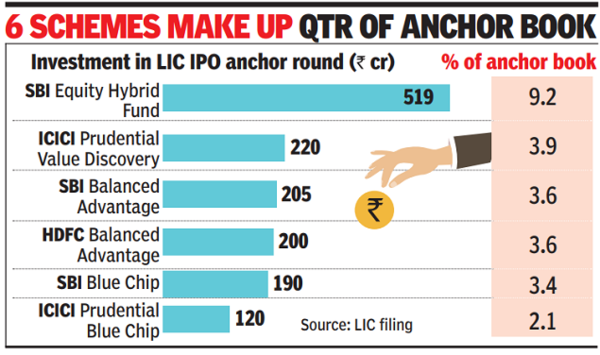

In a stock exchange filing, the corporation said it has finalized the allocation of 5.92 crore shares to anchor investors at the anchor investor allocation price of Rs 949. Besides SBI, the other largest mutual fund investor was ICICI Prudential which picked up Rs 700 crore worth of shares and HDFC Mutual Fund Rs 650crore. Overall, 15 domestic mutual funds invested over Rs 4,000 crore through 99 schemes.

Among foreign investors, the largest subscription came from the Singapore government’s wealth fund (GIC), followed by BNP Investments. The lukewarm participation from foreign investors comes when foreign institutional investors have been net sellers in the stock exchanges this year. Foreign investors have been exiting emerging markets in the wake of the economic uncertainty arising out of the Russian invasion of Ukraine.

Despite the poor show by foreign investors and the oversized issue, many brokerage firms recommend the LIC IPO to investors in the wake of the government adopting a conservative valuation.

“At the upper end of the price band, the LIC IPO is offered at a price to the embedded value of 1.1x as compared to other listed private life insurance companies like HDFC Life, ICICI Pru Life, and SBI Life which are trading at multiples of 2.5-4.3x Sep ’21 EV. While LIC valuations appear to be cheap as compared to listed private players, investors need to keep in mind that LIC has a lower value of new business margin of 9.3% in 9MFY2021 as compared to private players who have VNB margins of 25-27%, ” said Yash Gupta- Equity Research Analyst, Angel One

According to Gupta, LIC has a lower valuation because of its higher share of low margin participating & group insurance products in LIC’s portfolio. “While there are concerns over LIC regarding market share loss in individual insurance businesses and historically lower margins, we believe that valuations factor in most of the negatives,” he added. Other factors supporting the issue are the expected improvements in product mix, and more significant transfer of surplus to shareholders account over the coming years which would drive profits from current low levels.

,