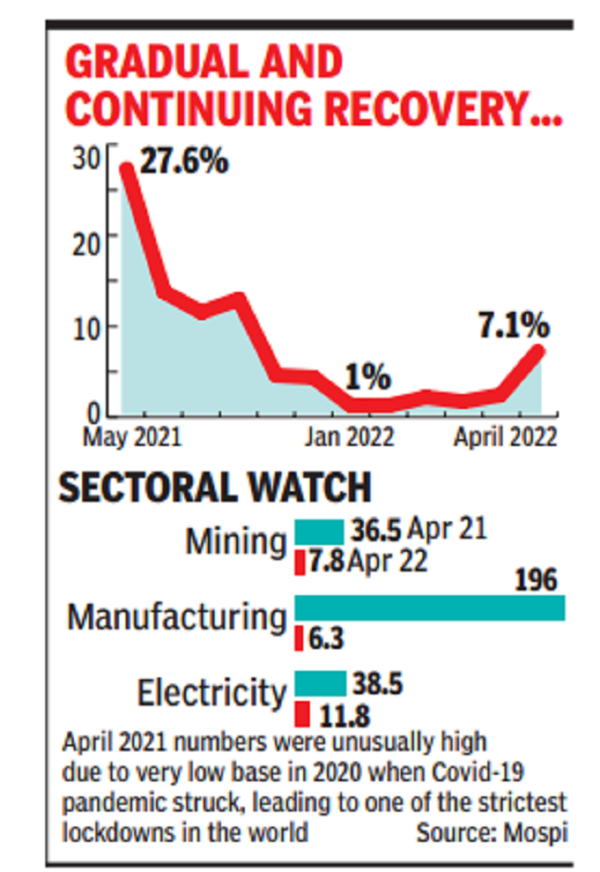

Data released by the National Statistics Office (NSO) showed the index of industrial production on Friday (IIP) rose 7.1% yearly in April, compared to an upward revised 2.2% in March. The sector grew by 133.5% in April 2021, due to a very low base of 2020, when the Covid-19 induced lockdown hit economic activity and growth.

Several indicators pointed to the pace of recovery, including PMI Manufacturing survey and GST receipts. The effects of the war in Ukraine and the breakdown of supply chains have put pressure on prices, which will have an impact on growth and the growing manufacturing sector. But economists were surprised by the resilience of the sector, though they pointed to weak spots that still needed to be looked at in the manufacturing sector.

The manufacturing sector grew 6.3% year-on-year in April, up from 1.4% in March and the power sector grew by 11.8% as compared to 6.1% growth in the previous month.

“When compared with the pre-Covid level of April 2019, the IIP in April 2022 was 6.8% higher, with double-digit growth in intermediates, infrastructure and primary goods, thanks to the flattening performance of consumer non-durables. middle, and one was unattainable. Contraction in capital goods and consumer durables,” said Aditi nairChief Economist at rating agency ICRA.

He added that consumption as a whole remains temporary, with underlying inequality. Led by stagnant demand, the agency expects demand for services to outperform demand for goods in the near future, the latter being further constrained by increased prices.

Nair said the weak performance of capital goods production relative to pre-Covid levels confirms the view that the accelerating capacity utilization in the fourth quarter of FY2022 is likely to overestimate the capacity of the private sector in light of the uncertainties posed by geopolitics. Will not expand fast. Development.

reserve Bank of India The U.S. has retained its GDP growth forecast of 7.2% for 2022-23, but raised its inflation forecast to 6.7% from 5.7% earlier, citing geopolitical situation. The central bank has so far raised rates by 90 basis points and expects more rate hikes to check inflation, which is trending upwards. reserve Bank of IndiaUpper tolerance band. The rate hike will impact the overall expansion as the focus is on containing price pressures.

“The IIP growth numbers reinforce the confidence given by PMI and GST collections during this challenging period. We need to see whether this momentum can be continued as it will be a prerequisite for sustaining GDP growth of over 7% this year. Will be the mantra of sustenance as corporates also ended the year on a good note in the fourth quarter. Demand from consumers and investments by corporates will give clues in the coming months Mrs. SabnavisChief Economist of Bank of Baroda.