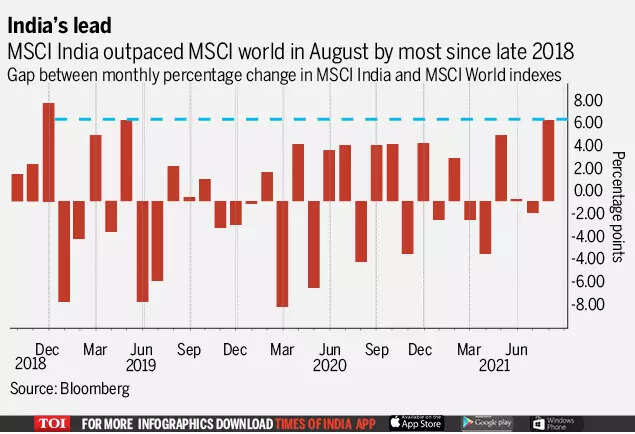

NS MSCI India Index It beat the MSCI World gauge of developed countries by more than six percentage points last month, the biggest difference since 2018.

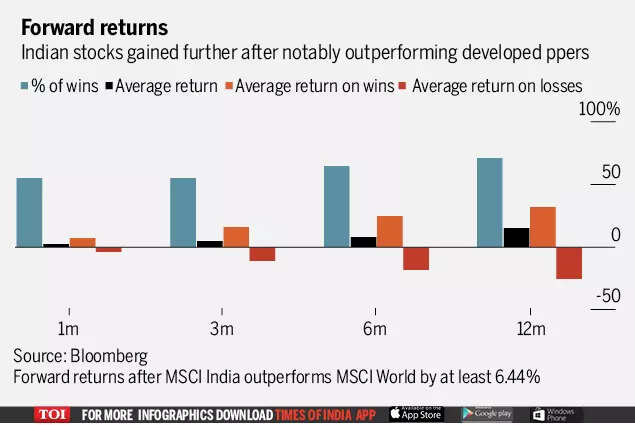

According to data compiled by Bloomberg, the average return from a household gauge after 12 months of such relative outperformance is 15%.

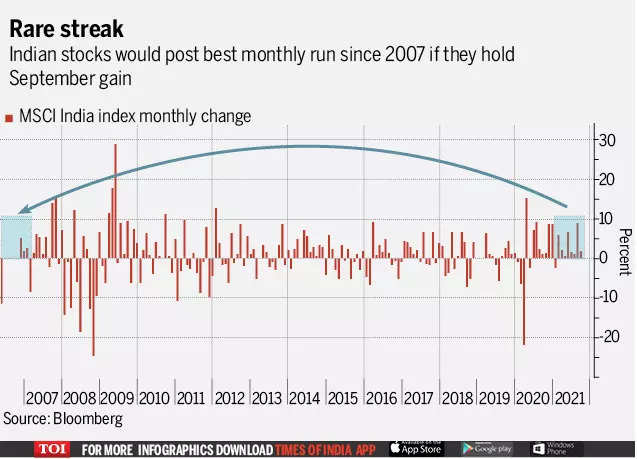

The index is also eyeing its eighth consecutive monthly advance. Such a streak has been observed only twice in the last two decades, in 2003 and 2007. The average return a year after these observations was just over 19%.

Deepak Jasani, Head of Retail Research, HDFC Securities Ltd. said, “While we expect the index to continue to do well, the market may remain narrow as investors are now betting on proven stocks and avoid paying more for them. Don’t mind.”

The tide of foreign inflows and domestic liquidity has helped fuel a 132 per cent rise in Indian stocks since the March 2020 pandemic. It naturally cautions about increased valuations and a potential reduction in Federal Reserve stimulus that could suck money out of emerging markets. At the same time, the pace of the rally remains a draw for optimists.

According to Rajeev Pramanik, senior EM strategist at BCA Research Inc., the higher valuation of stocks is a risk, the better and less volatile corporate earnings growth suggests that the premium relative to other emerging countries will remain the stock.

.