“During Covid, the Monetary Policy Committee deliberately decided to tolerate inflation ranging from 4% to 6%. Had we been very firm on keeping it at 4%, the result would have been disastrous for the economy. The economic damage would have been enormous and it would take years for India to come back,” the governor said.

He said that under the RBI Act, the Monetary Policy Committee sets the policy interest rate to maintain price stability while pursuing the objective of growth. Das was addressing a banking conference in Mumbai. Das said the high inflation tolerance has certainly contributed to the economy’s revival and has placed it in a better position than many other countries.

The governor also refuted the criticism that the RBI was behind the curve. “I truly and sincerely believe that the RBI is in sync with the needs of the economy and the trend of economic growth and what you call the ‘curve’.” Arvind Subramaniam who co-authored an article which stated that the RBI was behind the inflation curve and that it was a failure of the institution and its railing. “Our focus was to see the economy reach a stage where we could extract liquidity and low interest rate support. We wanted growth to reach a level where it would be stable. As I mentioned in the policy, when the boat was close to shore we did not want to shake it,” Das said.

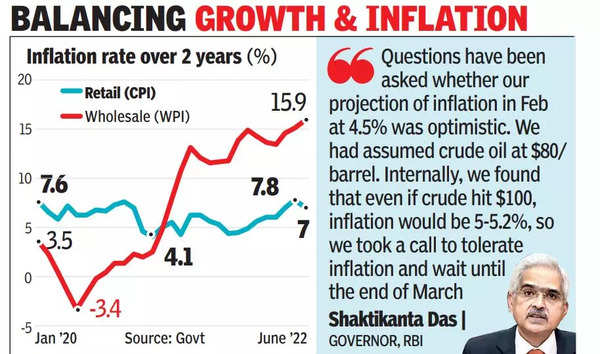

“The question asked is whether our estimate of inflation at 4.5% in February was optimistic. We had assumed crude oil at $80 per barrel. Internally we found that even if crude reaches $100, inflation will be 5-5. 2%. So, we took a conscious call to bear inflation for some more time and wait till the end of March,” Das said. In April 2022, Das raised floor rates in the money markets by introducing a permanent deposit facility, which would pay banks higher returns than reverse repo (a tool the RBI uses to borrow from banks). This made reverse repos ineffective and replaced the permanent deposit facility (SDF) with the lowest rate, and many saw it as a sneaky monetary tightening to avoid destabilizing the markets. Das confirmed that the introduction sdf There was a stringent measure aimed at raising money market rates.

According to Das, even though the RBI had announced several liquidity measures following a 24% contraction of the economy during the first quarter of the pandemic, each measure had an expiration date.